Being the last trading of September, we can comfortably look back and see who how strongly the US Dollar has been performing this last month against the other majors as a whole. Back in early September, I wrote in the column ‘The era of the US Dollar has truly come’, about how the market was reassuring as leaving little doubt to the return to trend. The golden advice of trading where “a trend is a friend” stays true. While we see no signs of reversal on the Dollar yet, the best strategy now would still be to follow the trend.

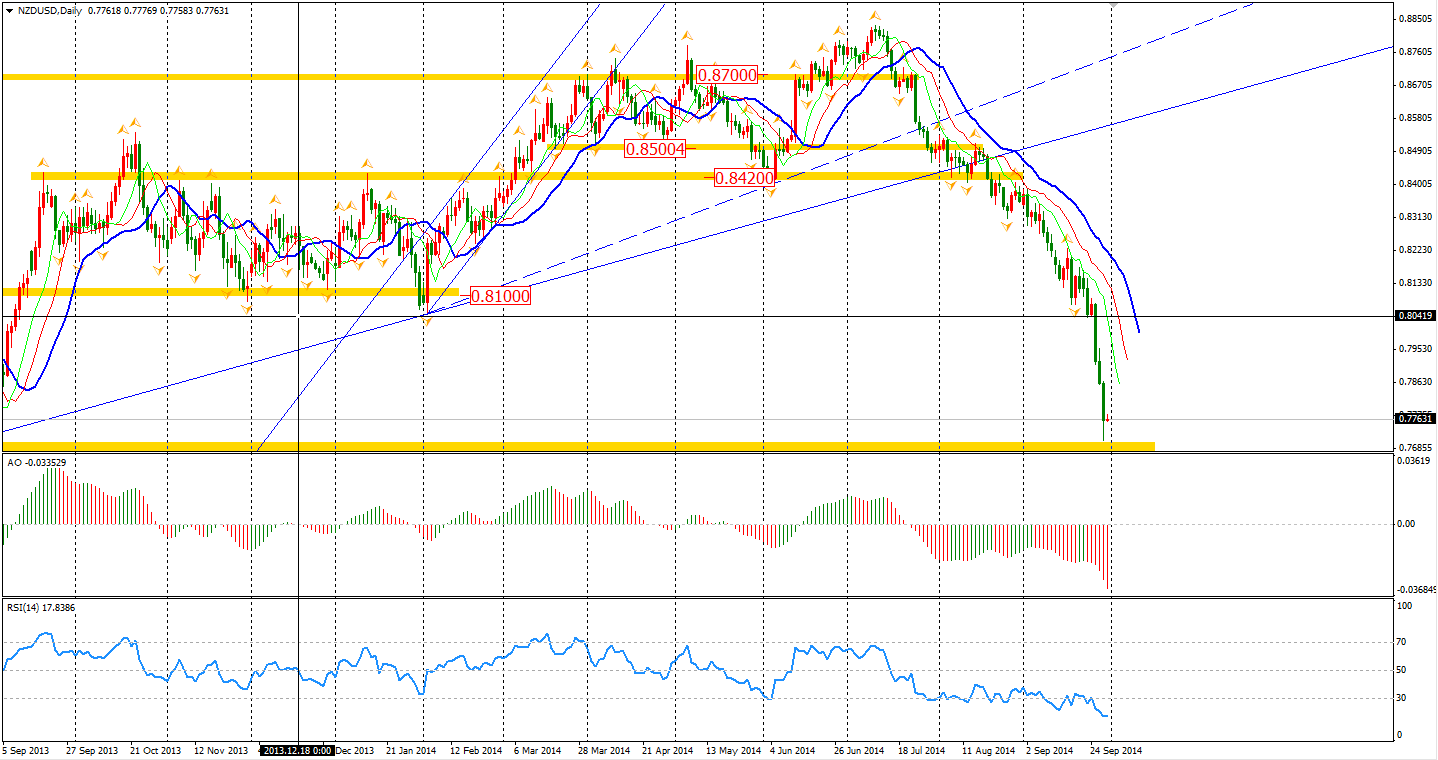

The New Zealand Dollar was the weakest major currency yesterday, falling 1.3% against the US Dollar. In the Asian Monday morning session, the RBNZ disclosed that the central bank had intervened in the forex market in August selling a net of NZ$521 million – the highest amount in seven years. The Kiwi/Dollar dropped to a day low of 0.7709 after the news. The RBNZ thinks the fair level should be 0.65 yet it seems like the fall won’t be over in the middle run.

Just like how carry trade strategies would fail as volatility returns, will the global stock market bull trend stop as the economy slows down and higher risk is making some investors withdraw their investments?

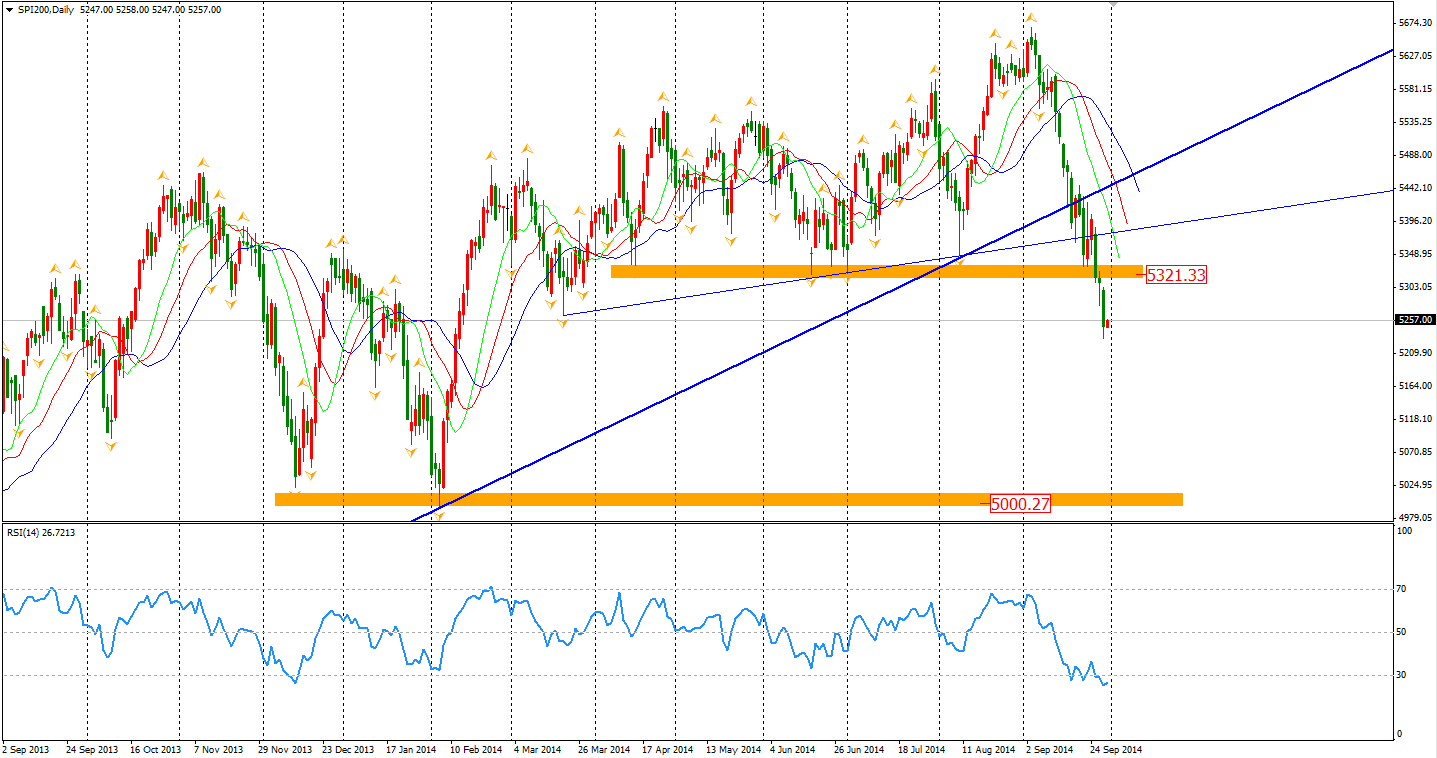

The Australian ASX 200 slumped by 0.93% to 5264. The index has already broken the bullish trendline formed since mid-2012 and also the support near 5320. From a technical view, it is heading towards the year’s low 5000 integer level.

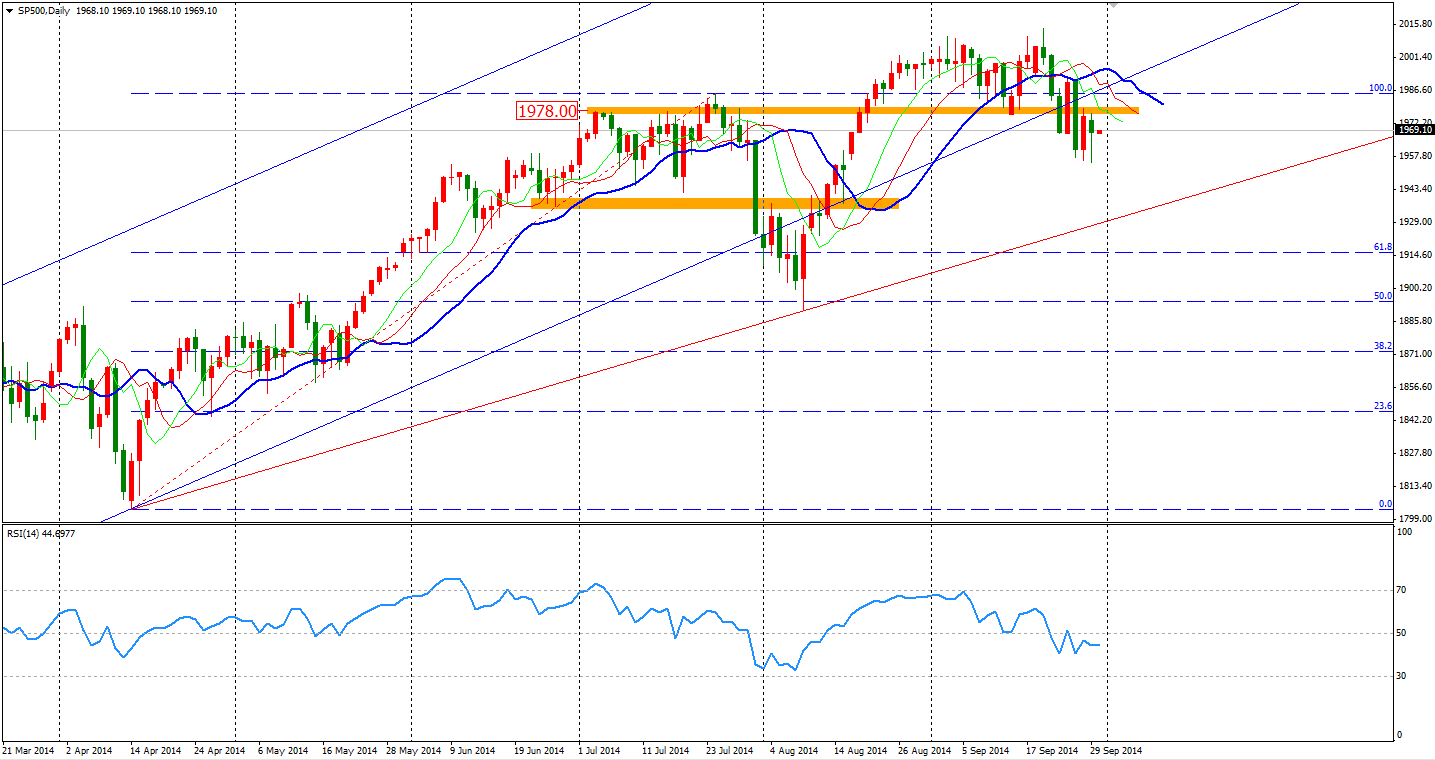

In other Asian stock markets, the Shanghai Composite moved by 0.43% up to 2357. The Nikkei Stock Average rebounded by 0.5%. In European stock markets, the UK FTSE was down 0.04%, the German DAX lost 0.71% and the French CAC Index fell 0.83%. U.S. stocks continued the weakness. The S&P 500 lost 0.25% to 1978. The Dow edged down 0.25% to 17071, while the Nasdaq Composite Index dropped 0.14% to 4506.

We also saw a reverse sign for the S&P 500 as it failed to rise back to the area beyond the 1978 level. A bottom top pattern has revealed itself in the daily chart.

For the data front, the UK Current Account and Unemployment Rate will be closely watched at 18:30. The Eurozone CPI and Unemployment Rate will be 30 minutes after this. At the beginning of US trading hours, the Canada GDP and US CB Consumer Confidence will be released.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.