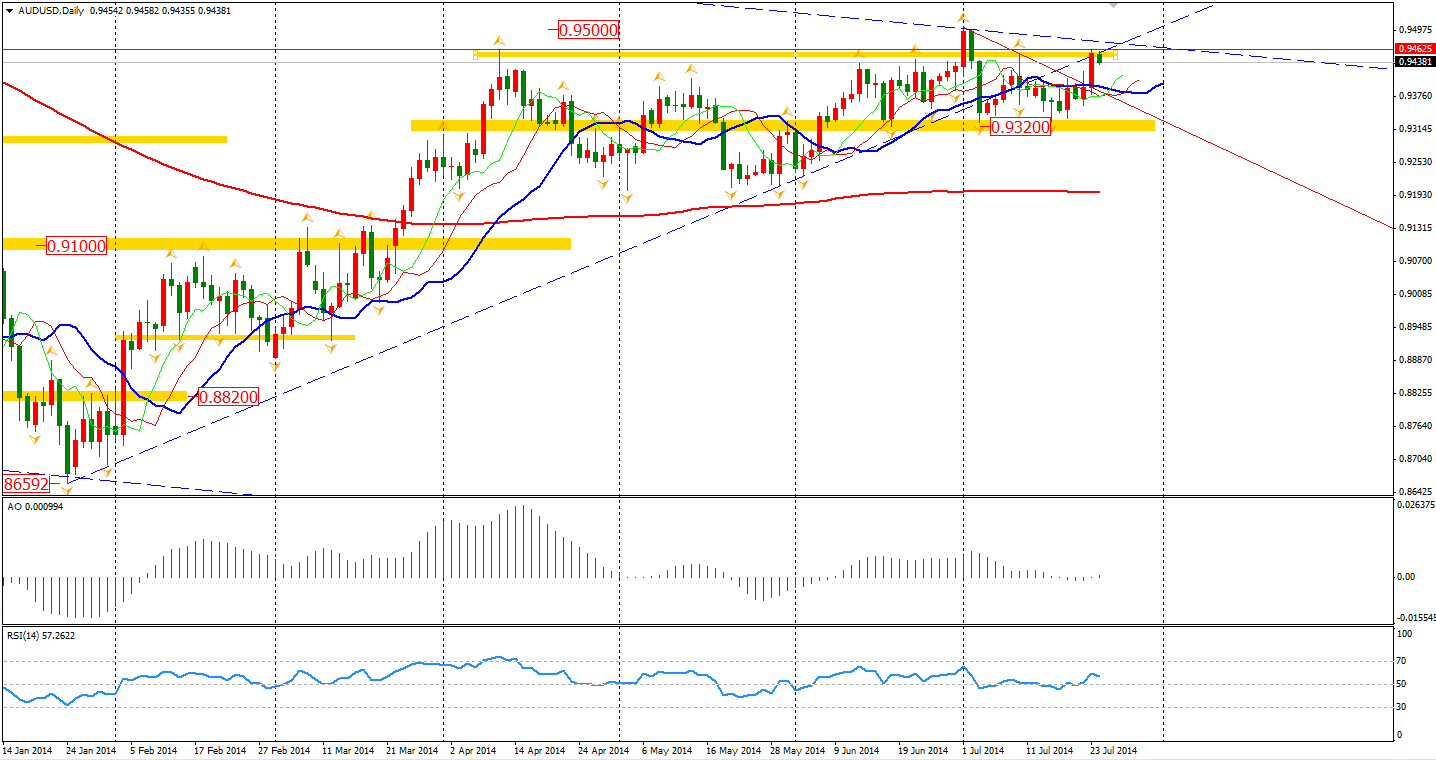

The Australian CPI annual rate reached the 3% upside boundary of RBA long term inflation. The Aussie surged over 50 pips to earlier highs of 0.9456 after the release. Personally though, I don’t think this will mean the RBA will raise its interest rate anytime soon as the economy still needs the time to recover strength. This might be a good area for some long-term strategy traders to short the Aussie Dollar.

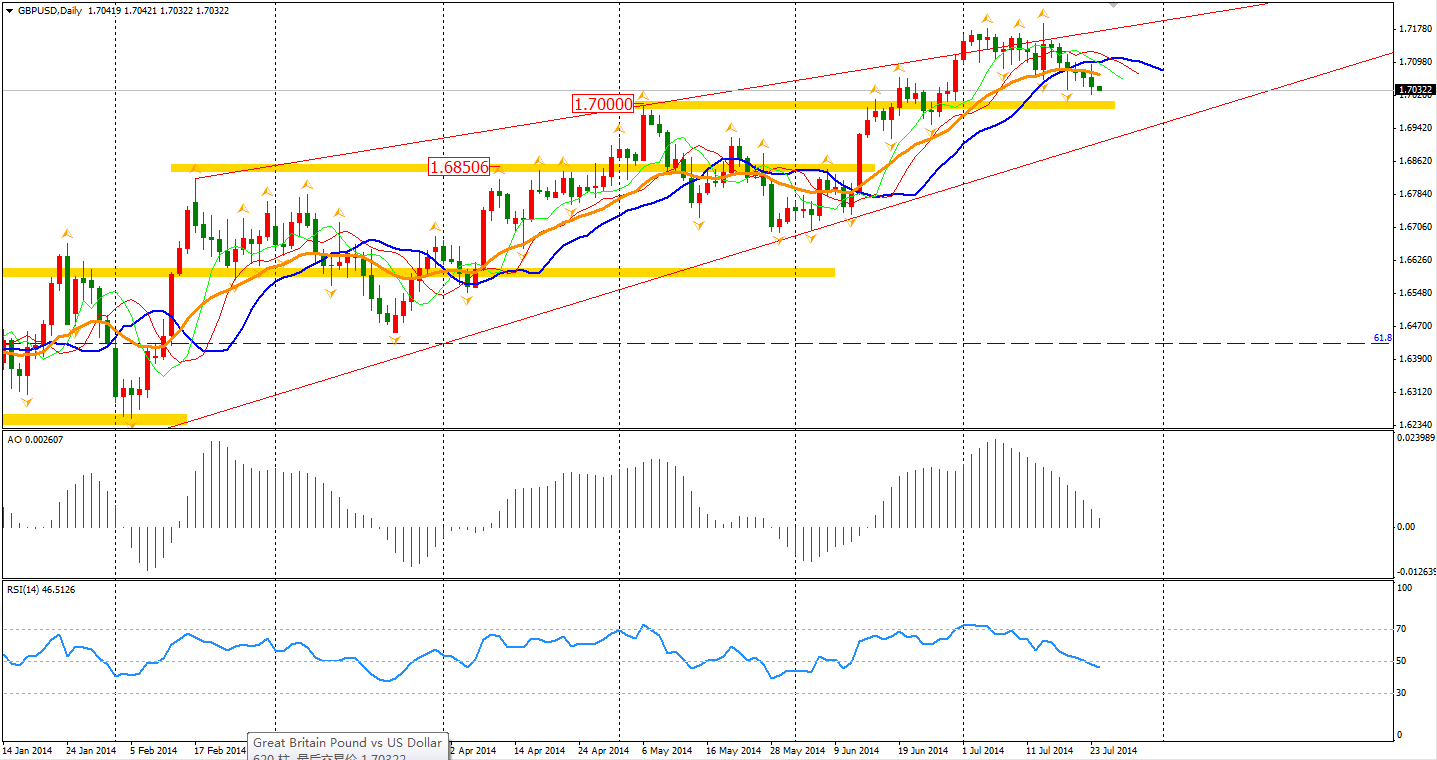

The BOE’s minutes revealed policymaker’s concerns on how the growth perspective may continue on the weak side and that early rate rising will dampen the UK’s economy. In MPC members’ view, the boost of real estate is not sustainable and there is no need to curb inflation in short term. The meeting record is certainly more dovish than former statement. Sterling fell to 1.7023, but still remain beyond support level of 1.70.

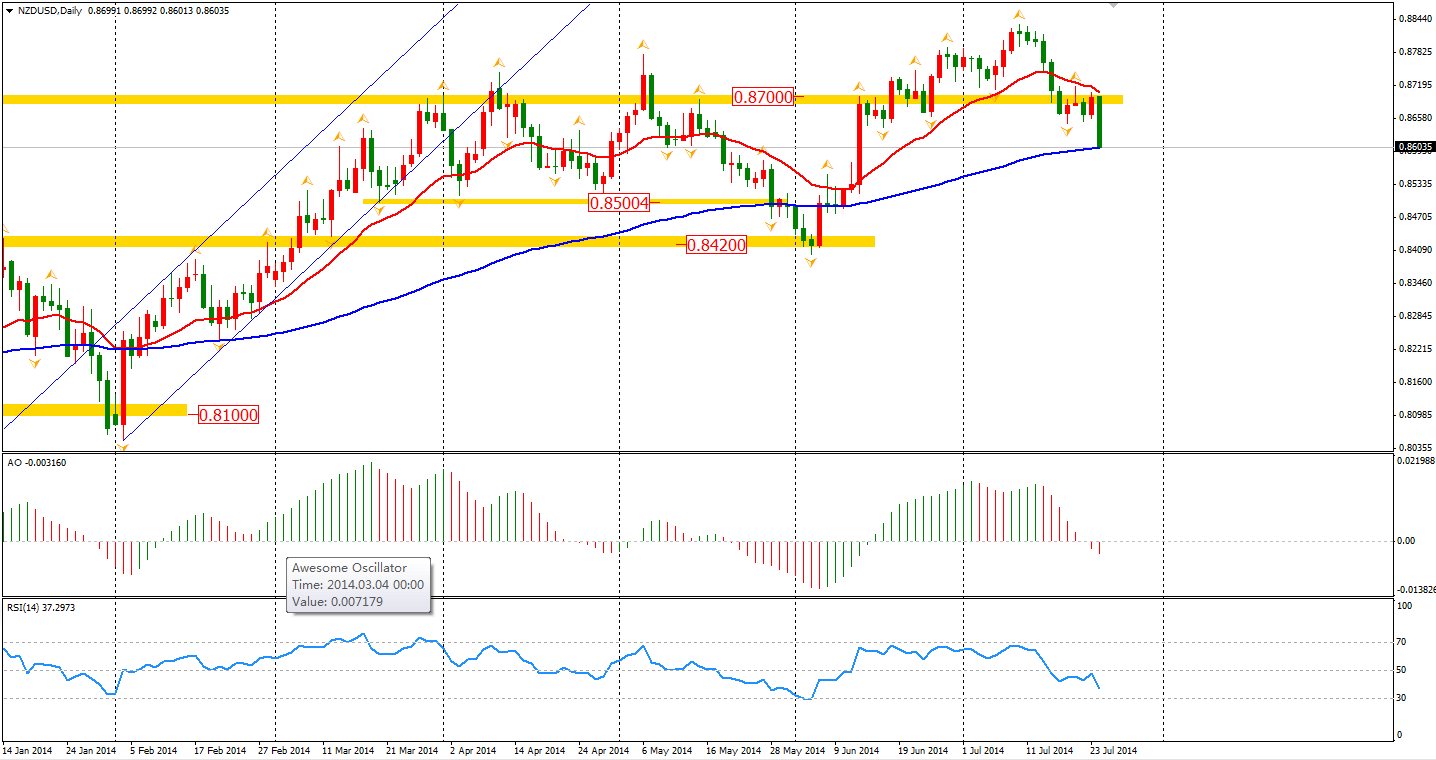

Kiwi Dollar slumped earlier this morning after New Zealand Central Bank RBNZ decided to raise interest rate another 25bp to 3.5% as forecasted. However, as economic data was not as strong as the RBNZ expected, the further raise may be delayed. The support level at 0.8650 has been broken and is now temporarily supported by 100-day MA at 0.86.

Most Asian markets made gains yesterday with Australian stocks inspired by an upbeat CPI and hit a six-year high. The Australian ASX 200 rose 0.6% to 5577. The Nikkei Stock Average went down 0.1%. Shanghai Composite gained 0.14% to 2078. In European stock markets, the FTSE closed 0.4% higher, the DAX edged 0.2% higher, and the French CAC was up 0.16%. U.S. stocks were supported by upbeat corporate earnings. The Dows slid 0.16% to 17087. The S&P 500 edged 0.18% higher to 1987, while the Nasdaq Composite Index rose 0.4% to 4474.

On the data front, investors may first pay attention to the China HSBC Flash Manufacturing PMI at 11:45 AEST. The Eurozone PMIs will be released right after the European markets open. UK Retail Sales will be out at 18:30 AEST. U.S. Unemployment Claims and New Home Sales will be released at midnight tonight.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.