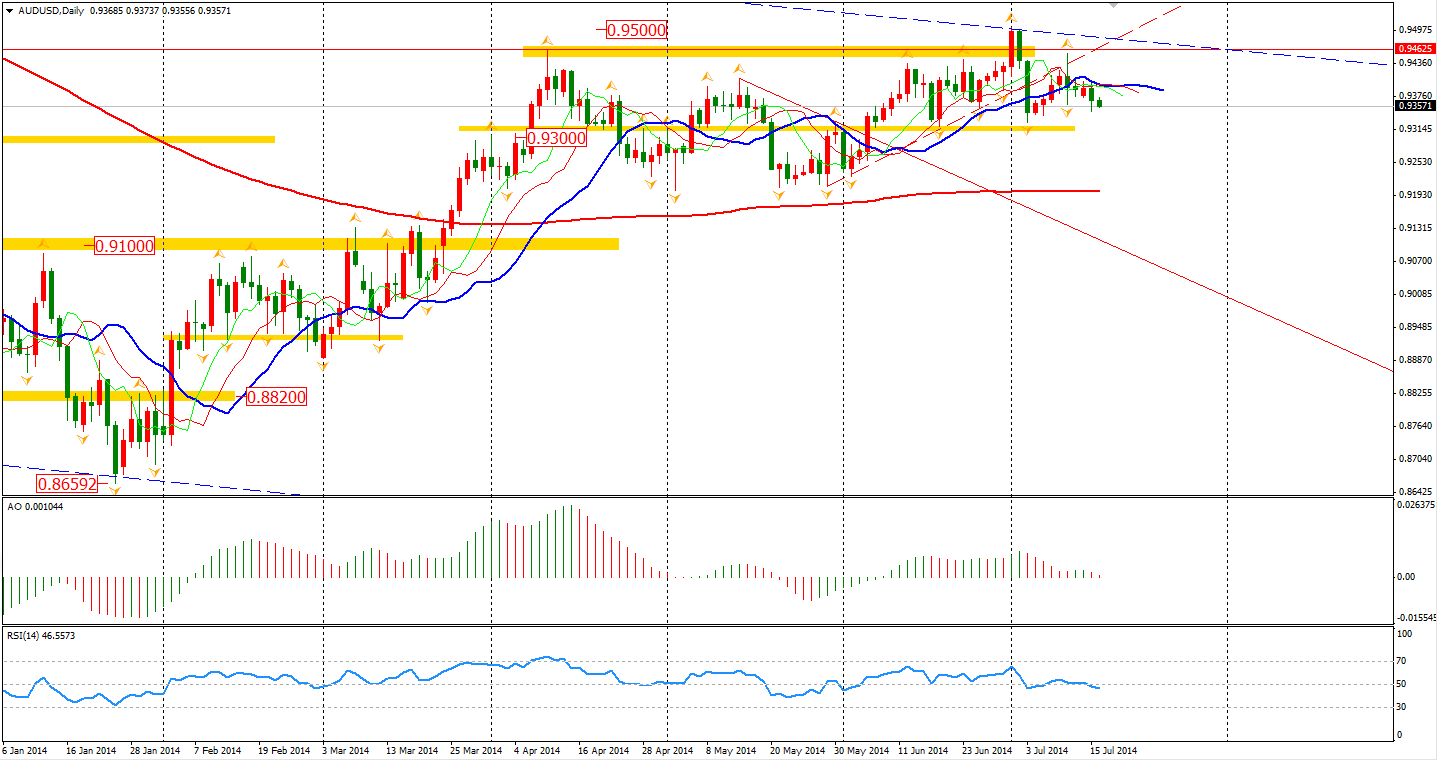

As usual, the RBA policy meeting minutes referred to the Australia Dollar as overvalued, especially now with commodity prices at these low levels. The Committee expects GDP growth may be lower than average levels in the next year and will maintain the current interest rate for a while.

However, board member John Edwards posted a stronger remark on the strength of the Aussie Dollar sharing with the markets that the RBA has actually been concerned with the exchange rate. This raises expectations that the Central Bank could cut the rate to dampen the currency’s level.

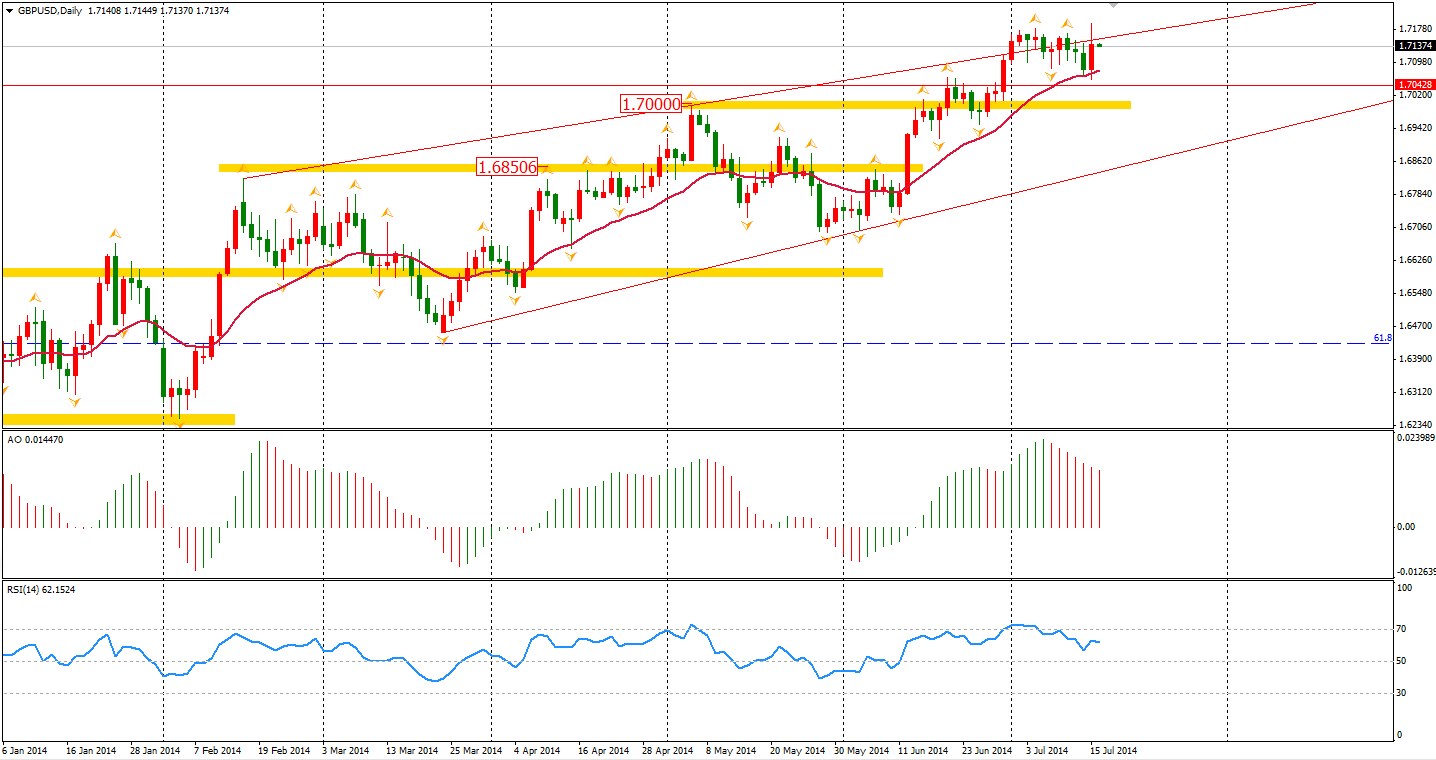

In the European session, the Sterling was boosted by the upbeat inflation data, rising against the Dollar by over 100 pips to a 1.7190 fresh high. The CPI jumped to 1.9% year on year – higher than the expected 1.6% and previous results of 1.5%. Core CPI which excludes the food and energy rose to 2%. These data results certainly increase the pressure on BOE policy makers to raise interest rates.

The short term bullish pattern of Pound/Dollar continued and price was supported by the 20-day MA. But personally, I have reservations whether the rising will continue on. Traders may need to watch the Unemployment Rate tonight.

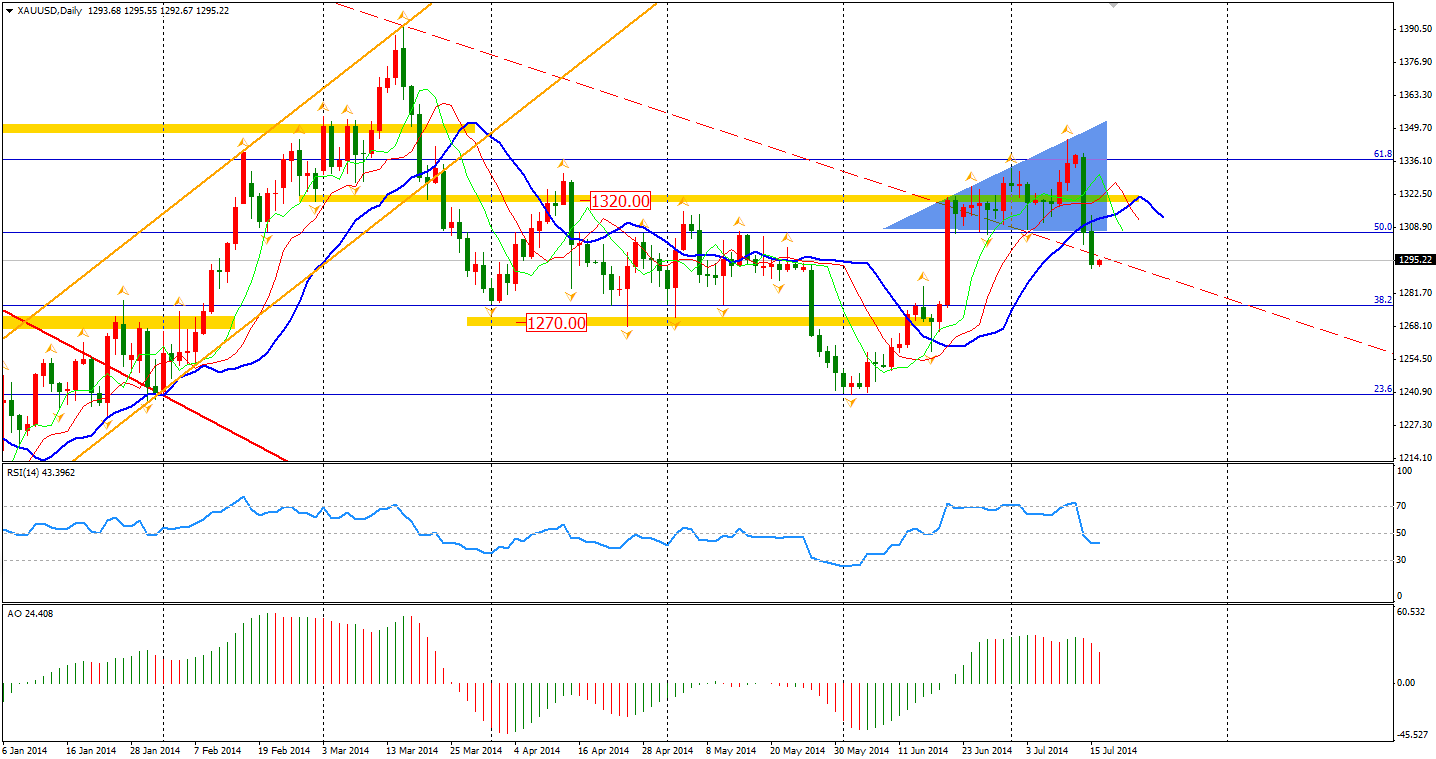

Fed Chair Yellen noted in her testimony that the recovery of U.S. economy is not complete and unemployment levels remain high. However, she later mentioned that if labor market improves faster than expected, then the rate would rise sooner. As covered yesterday, this has already encouraged a new round of gold selling with its price falling below $1300.

The Asian market closed higher yesterday, following the upbeat performance of the U.S. market. The Nikkei Stock Average rose 0.64%. Shanghai Composite closed 0.18% higher to 2070. The Australian ASX 200 closed flat at 5511. In European stock markets, the FTSE closed 0.53% lower, the DAX lost 0.65%, and the CAC was down 1.03%. U.S. stocks closed slightly lower while the Dow Jones Industrial Average touched a fresh intraday high. The Dows gained 0.03% to 17061. The S&P 500 edged 0.54% lower to 1973, while the Nasdaq Composite Index fell 0.54% to 4416.

On the data front, UK Unemployment Rate will be at 18:30 AEST and U.S. PPI will be at 22:30 AEST. Fed Chair Yellen will have another testimony before the Representatives starting from 12:00 AEST. Asian investors should also keep an eye on China GDP as this will also be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.