USD/JPY has edged lower on Thursday, following losses which marked the Wednesday session. In the European session, the pair is trading slightly above the 109 level. On the release front, Japanese bond yields continue to fall, as 30-year bonds dropped to 0.39% in the April auction. The US will releases consumer inflation reports later in the day, as well as Unemployment Claims. On Friday, we’ll get a look at the UoM Consumer Sentiment Index, a key gauge of consumer confidence.

The yen has been on an impressive run since late March, although USD/JPY has posted gains this week. With the symbolic 100 level within striking distance, the Japanese government has sent out warnings about possible intervention to slow down the yen’s huge appreciation, which has hurt the export sector. Earlier this week, Chief Cabinet Secretary Yoshihide Suga said that although Japan would adhere to the Group of 20’s agreement to avoid competitive devaluations, this did not preclude Japan from intervening against “manipulation of currencies”. The yen has jumped 10 percent in 2016, and despite the tough intervention talk, the upward trend could resume, as the safe-haven yen remains attractive to investors in a turbulent global economy. Despite the yen’s upswing, the currency is widely considered as undervalued against the dollar.

A weak Japanese economy continues to put strong pressure on the Bank of Japan to take additional monetary action. The BoJ cannot be blamed for a lack of effort, as the central bank took radical action in January, adopting negative interest rates for the first time in its history. Despite these moves by the central bank, growth and inflation levels have not improved. If the markets feel that the BoJ has no more monetary easing ammunition left, the yen could continue to strengthen. The next BoJ policy meeting takes place at the end of the month. Will the central bank adopt further easing measures at its meeting or is the monetary tool box empty?

The US released retail sales and inflation reports on Wednesday, and the results were a disappointment across the board. Core Retail Sales improved to 0.2%, but fell short of the forecast of 0.4%. Retail Sales surprised with a decline of 0.3%, shy of the estimate of a 0.1% gain. This marked the second straight drop for the indicator. Consumer spending represents the biggest part of the economy, so these figures could spell trouble at a time that the export sector remains soft due to weak global demand. There was no relief from PPI, a key gauge of inflation in the manufacturing sector. The index dipped 0.1%, its third decline in four releases. This was well off the estimate of a 0.3% gain. Will we see some relief from CPI on Thursday? If not, the dollar could lose ground. A weak reading would also raise concerns about the strength of the US economy, and could dent hopes for a June rate hike by the Federal Reserve, which is unlikely to make any moves before inflation levels rise.

USD/JPY Fundamentals

Wednesday (April 13)

- 23:45 Japanese 30-year Bond Auction. Actual 0.39%

Thursday (April 14)

-

8:30 US CPI. Estimate 0.2%

-

8:30 US Core CPI. Estimate 0.2%

-

8:30 US Unemployment Claims. Estimate 270K

-

10:30 FOMC Member Jerome Powell Speaks

-

10:30 US Natural Gas Storage. Estimate 1B

-

13:01 US 30-year Bond Auction

| S3 | S2 | S1 | R1 | R2 | R3 |

| 106.25 | 107.57 | 108.37 | 109.87 | 110.66 | 111.50 |

-

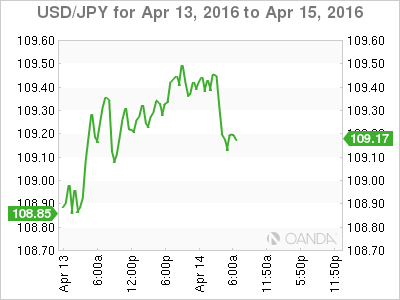

USD/JPY posted small gains in the Asian session but the pair has retracted in the European session

-

There is resistance at 109.87

-

108.37 is providing support

-

Current range: 108.37 to 109.87

Further levels in both directions:

-

Below: 108.37, 107.57, 106.25 and 105.19

-

Above: 109.87, 110.66 and 111.50

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.