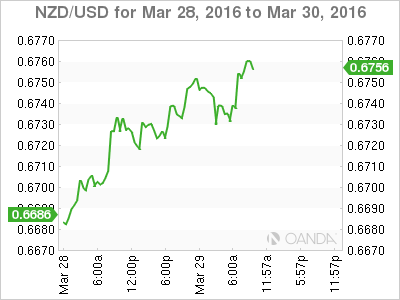

NZD/USD has posted small gains on Tuesday, as the pair trades at 0.6750 at the start of the North American session. On the release front, US CB Consumer Confidence is expected to climb to 93.9 points. As well, Federal Reserve Janet Yellen will deliver remarks at the Economic Club in New York City. Later on Tuesday, New Zealand will release Building Consents.

Consumer spending is a key driver of the economy, so weak US consumer numbers on Monday is raising concerns in the market. Core PCE Price Index and Personal Spending both softened in February, posting weak gains of 0.1 percent. CB Consumer Confidence, a key indicator, follows on Tuesday, with the markets expecting the indicator to improve in February. Analysts will be keeping a close eye on this event, as consumer confidence is closely linked to consumer spending.

US economic growth was a respectable 1.4 percent in the fourth quarter, but there are signs that we could see softer numbers for the first quarter of 2016. The Atlanta Fed downgraded its forecast for Q1 from 1.4 percent to 0.6 percent. The original forecast, released just last week, was lowered in response to a downgraded forecast of personal income and outlays by the US Bureau of Economic Analysis. If US economic activity did in fact weaken in Q1, we could see the US dollar lose ground.

After a dovish policy statement from the Fed earlier this month, the markets assumed that a rate hike was off the table for the near future. However, a flurry of hawkish statements from Federal Reserve members last week caught the markets by surprise and resulted in broad gains for the dollar, as the Aussie dropped close to 100 points. With some Fed members calling for a rate hike as early as April, the markets will be looking for some guidance from Fed chair Janet Yellen, who will make a speech in New York later on Tuesday. If Yellen does not rule out an April move, speculation of an imminent rate hike will increase, and the US dollar could respond with broad gains.

NZD/USD Fundamentals

Tuesday (March 29)

9:00 US S&P/CS Composite-20 HPI. Estimate 5.7%

10:00 US CB Consumer Confidence. Estimate 93.9

12:20 US Federal Reserve Chair Janet Yellen Speaks

17:45 New Zealand Building Consents

Upcoming Key Events

Wednesday (March 30)

- 12:15 ADP Nonfarm Employment Change. Estimate 194K

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6499 | 0.6605 | 0.6738 | 0.6897 | 0.7011 | 0.7100 |

NZD/USD posted gains in the Asian session. The pair dropped in European trade but then recovered.

0.6738 remains busy and has switched to support. It is a weak line

There is resistance at 0.6897

Further levels in both directions:

Below: 0.6738, 0.6605, 0.6449 and 0.6344

Above: 0.6897, 0.7011 and 0.7100

Current Range: 0.6738 to 0.7011

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.