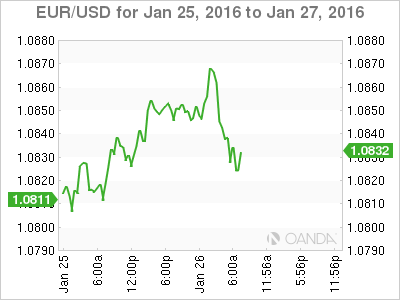

EUR/USD, is almost unchanged on Tuesday, as the pair trades at 1.0840 in the European session. In economic news, there are no Eurozone releases on the schedule. In the US, today’s highlight is CB Consumer Confidence, with the estimate standing at 96.6 points. On Wednesday, the Federal Reserve will release its policy statement.

At the ECB policy meeting last week, the ECB did not lower interest rates and held off from additional monetary easing. This time the euro did not react with sharp gains, unlike the December ECB meeting, when the lack of action by the central bank surprised the markets, and EUR/USD racked up huge gains. At last week’s meeting, ECB President Mario Draghi noted that he reserved the right to “review and reconsider” the ECB’s monetary policy in March. Draghi reiterated this message at the World Economic Forum in Davos, Switzerland. So what does this mean for the markets? In December, the markets were banking on some strong monetary action from the ECB. When this didn’t materialize, the result was huge volatility from the euro. Draghi doesn’t want a repeat of this fiasco, and is sending out the message that although he’s not prepared to make any moves right now, the ECB could increase monetary easing if inflation and growth numbers in the bloc worsen in the next two months.

The Federal Reserve will be in the spotlight on Wednesday, as the Fed concludes a two-day meeting and issues a policy statement. It’s unlikely that the Fed will raise interest rates, which currently stand at 0.25%. Economic conditions have changed significantly since the Fed raise rates in mid-December, with global stock markets and oil prices sharply lower in the since the historic rate hike. According to Morgan Stanley Morgan chief economist Ellen Zentner, financial conditions have tightened by the equivalent of four rate hikes, so the Fed may hold off from further tightening for the near future. We can expect the Fed to perform a balancing act in the upcoming statement, acknowledging weaker economic conditions while emphasizing that the economy continues to grow. The collapse of oil prices has contributed to the weak inflation picture, with current inflation levels well below the Fed target of 2.0%. Traders should be prepared for possible volatility following the upcoming policy statement.

Tuesday (Jan. 26)

14:00 US HPI. Estimate 0.4%

14:00 S&P/CS Composite-20 HPI. Estimate 5.7%

14:45 US Flash Services PMI. Estimate 53.9 points

15:00 US CB Consumer Confidence. Estimate 96.6 points

15:00 US Richmond Manufacturing Index. Estimate 3 points

Upcoming Key Events

Wednesday (Jan. 27)

14:00 FOMC Statement

14:00 Federal Funds Rate. Estimate <0.50%

Open: 1.0852 Low: 1.0834 High: 1.0874 Close: 1.0841

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0537 | 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1087 |

EUR/USD has been flat in the Asian and European sessions

1.0732 is providing strong support

1.0847 was tested earlier in resistance and could break during the day

Current range: 1.0732 to 1.0847

Further levels in both directions:

Below: 1.0732, 1.0659 and 1.0537

Above: 1.0847, 1.0941, 1.1087 and 1.1172

-------

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.