Plunging Oil Prices and Scarce Details on Fiscal Stimulus Might Force BoC to Cut Interest Rate

At the end of 2015 the possibility of a rate cut from the Canadian central bank in January was low with the majority of analysts putting it beyond the first quarter of 2016. The Federal Reserve had just announced a much-awaited rate hike to the U.S. benchmark which gave some breathing room to the Bank of Canada (BoC) regarding its next move. The CAD depreciated giving an edge to exporters and boost growth expectations. Now the rapid decline of oil (10.85 percent last week) might force the hand of BoC governor Stephen Poloz. Economists and analysts are divided on what to expect next week as Canadian fundamentals have shifted. Even if the moves are not a surprise, as they were for the most part anticipated, the speed in which they developed and the market reaction has many updating their forecasts of the Bank of Canada’s next move.

Opinions and forecasts are divided on the BoC announcement. A year ago the central bank proactively cut rates ahead of the decline in energy prices. The BoC would cut the interest rate an additional time in 2015 for a record low 0.50 percent. The Liberal’s government lack of details on the March budget that is said to include fiscal stimulus puts the weight of the economy squarely on Stephen Poloz and the Bank of Canada.

The Bank of Canada (BoC) will announce its Rate Statement along with its Monetary Policy report on Wednesday, January 20 at 10:00 am EST. At 10:30 am EST the U.S. Department of Energy will release crude inventories. BoC Governor Stephen Poloz will offer a press conference at 11:15 am EST. The combination of monetary policy announcement and commodity inventories will guide the price action of the CAD. Investors will be monitoring the announcements and their impact on the Canadian currency.

The USD/CAD had another volatile trading day on Tuesday with little to show for it if only looking at the open and close for the past 24 hours. The USD appreciated 0.016 percent versus the CAD, but the currency pair at one point traded as low as 1.4432 making the gap between the high and low almost 1 percent in a day. Oil prices were higher with the positive news out to China serving to boost global demand for commodities. Reality set in as oil gave back gains and in turn hurt the CAD that ended trading around 1.4560.

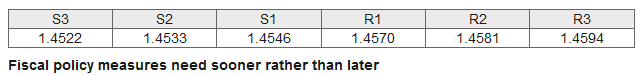

USD/CAD Technical

The Liberal government got into power last year on a platform of stimulus, but like market watchers they expected to reach a deficit as a result of their stimulus program, not start with one as the final budget report showed. Given the limited runway left to the Bank of Canada for rate cuts (0.50 percent) before going into negative territory, more is demanded of the government. Finance Minister Bill Morneau has been active in sending a message of reassurance as the government will follow through on its promises to invest in infrastructure and fiscal stimulus. The budget will be presented in March, but the timetable to discuss some of the new measures has moved up, given the sudden drop in energy prices.

The Canadian Prime Minister Justin Trudeau pledged that the Liberal budget to be unveiled in March will address the rapidly deteriorating economic factors. As part of the economic platform for the Canadian elections the Liberal party foresaw a need for fiscal stimulus to boost growth. The rapid decline of oil has put pressure on the Bank of Canada to avoid a rapid decline that could hurt the overall economy even if it can benefit exporters. The government needs to step in and lighten the load of the central bank and its commitment to stimulus is a step in the right direction.

The historic decision by the U.S. Federal Reserve to raise rates was announced in December, and since then the global macro economic headwinds have picked up strength to the point where the 4 interest rate hikes are seen as unlikely with forecasts calling for 2 or 3 as it is also an American presidential election year which would limit the interventions of the central bank during key months leading up to the election.

Canadian Fundamentals Buckling Under Pressure

Canadians were net buyers of foreign securities, adding to the outflows out of Canadian instruments. Investor confidence is not holding to well faced with the rapid decline of energy prices. This is the major argument for a Bank of Canada rate cut, as the loonie is already at a level where exports should thrive. The problem is two-fold. Manufacturing was decimated in the aftermath of the 2008 crisis with ironically the strong loonie the executioner as factories left for overseas destinations. Exports have recovered in those industries that can quickly adapt such as certain services. While that could provide a windfall for the entertainment industry as more productions move north, it does nothing for those cities not named Vancouver or Toronto.

The November data on securities purchases is not encouraging as even back then the outflow was reaching fever pitch and the price of oil and the loonie have only gone one way in the following two months. More important than the actual action of the Bank of Canada will be the tone Governor Stephen Poloz takes when addressing journalists. Last year was filled with communications misfires from Central Banks, and Poloz has a chance to start the year on the right track tomorrow.

CAD events to watch this week:

Wednesday, January 20

8:30am CAD Manufacturing Sales m/m

8:30am USD Building Permits

8:30am USD CPI m/m

10:00am CAD BOC Monetary Policy Report

10:00am CAD BOC Rate Statement

10:30am USD Crude Oil Inventories

11:15am CAD BOC Press Conference

Friday, January 22

8:30am CAD Core CPI m/m

*All times EST

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.