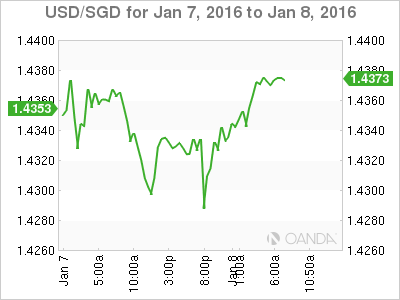

USD/SGD has posted modest gains on Friday, as the pair trades at the 1.4380 in the European session. On the release front, Singapore Foreign Currency Reserves were slightly higher than expectations. Over in the US, the markets are anxiously awaiting the Nonfarm Payrolls report, one of the most important economic indicators. The estimate stands at 203 thousand.

The Singapore dollar has started the New Year on a sour note, losing about 200 points this week. USD/SGD is trading close to 3-month highs, as the US dollar has hammered minor currencies such as the Singapore, Australian and New Zealand dollars. Why are investors scurrying to the safe-haven US dollar? The trend began early in the week, precipitated by disappointing Chinese manufacturing data which highlighted weak demand from the world’s number two economy. Market jitters intensified as tensions rose between Iran and Saudi Arabia and a nuclear device test by North Korea. Adding fuel to the fire, China has devalued the yuan by over 0.5%, triggering another bout of risk-aversion by investors. Singapore is an export-dependent economy, and the ongoing Chinese slowdown and a weaker yuan could be bad news for the island-state and push the Singapore dollar to lower levels.

US employment numbers are the main attraction on Friday, with the release of Nonfarm Payrolls and the Unemployment Rate. An unexpected NFP reading could have a sharp impact on the direction of AUD/USD, so we could see some volatility in the North American session. Earlier in the week, ADP Nonfarm Payrolls surged to 257 thousand in December. This crushed the forecast of 193 thousand, and was the strongest gain since June 2014. This week’s employment readings will be carefully monitored by the Federal Reserve, and strong numbers will increase speculation about another rate hike early in 2016.

The Federal Reserve released the minutes of its historic December policy meeting, at which it raised rates by 0.25 percent. The minutes were noteworthy in highlighting differences among policymakers as to whether US inflation levels will improve. Indeed, some FOMC members said that their vote in favor of a rate hike was a close call because of concerns that low inflation levels will continue in 2016. What’s next? The Fed has hinted that the December rate is the first of a series of incremental moves in 2016, but inflation levels will play an important role in the timing and size of future rate hikes.

USD/SGD Fundamentals

Thursday (Jan. 7)

- 4:00 Singapore Foreign Currency Reserves. Estimate 247.7B Actual 247.1B

Friday (Jan. 8)

8:30 US Average Hourly Earnings. Estimate 0.2%

8:30 US Nonfarm Employment Change. Estimate 203K

8:30 US Unemployment Rate. Estimate 5.0%

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.4139 | 1.4248 | 1.4368 | 1.4459 | 1.4530 | 1.4682 |

USD/SGD was flat in the Asian session, and has posted marginal gains in European trade.

1.4368 is a weak support line

1.4459 is an immediate resistance line

Current range: 1.4368 to 1.4459

Further levels in both directions:

Below: 1.4368, 1.4248, 1.4139 and 1.4073

Above: 1.4459, 1.4530 and 1.4682

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'