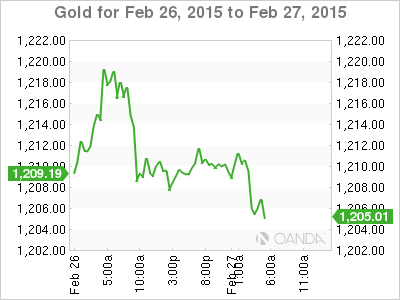

Gold has shown limited movement on Friday, as the spot price stands at $1205.02 in the European session. On the release front, the US will issue its second estimate of GDP for Q4, with a forecast of 2.1%. This is lower than the initial estimate of 2.6% in January. We’ll also get a look at Revised UoM Consumer Sentiment and Pending Home Sales.

Thursday’s US inflation and job numbers were not impressive. US inflation indicators continue to struggle. CPI posted a third straight decline, coming in at -0.7%. This was very close to the forecast of -0.6%. Core CPI improved to 0.2%, edging above the estimate of 0.1%. On the employment front, there was disappointing news, as Unemployment Claims jumped to a 6-week high, coming in at 313 thousand. This was much higher than the estimate of 288 thousand.

Greece and its international creditors have agreed to extend the bailout agreement after Greece’s list of economic reforms was accepted by the country’s creditors on Tuesday. Under this agreement, the Greek government has promised to continue with privatization plans and to meet budget targets. Still, the extension is a stop-gap measure and with sharp differences remaining between Greece and its creditors, the bailout crisis is far from over. If Greece and Germany again lock horns and raise doubts about whether Greece will remain in the Eurozone, we could see the euro lose ground.

Janet Yellen testified before Congressional committees on Tuesday and Wednesday, saying that the Fed was “unlikely” to raise interest rates in the next few months, given current economic conditions. Her remarks seemed aimed at quelling rising speculation about a rate hike sometime in mid-2015, which has helped boost the US dollar’s performance against its major rivals. Yellen noted that the continuing economic growth should lead to unemployment continuing to fall, but wages and inflation need to move higher before the Fed raises interest rates.

XAU/USD 1205.02 H: 1212.36 L: 1204.73

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.