The euro is flat on Friday, as EUR/USD trades in the low-1.13 range in the European session. On the release front, Eurozone releases were a disappointment. German Retail Sales posted a gain of 0.2%, while Eurozone CPI Estimate posted a sharp decline of 0.6%. In the US, today’s major events are Advance GDP and UoM Consumer Sentiment.

German Retail Sales posted a weak gain of 0.2%, marking a 3-month low. The estimate stood at 0.4%. Eurozone inflation remains anemic, as the CPI Estimate came in at -0.6%, its second straight decline. In Spain, CPI followed suit with a decline of -1.4%, although there was good news from GDP, which improved to 0.7% in Q4.

US key numbers were a mix on Thursday. This was underscored by Unemployment Claims, which plunged to 265 thousand, down from 307 thousand a week earlier. This marked the indicator’s lowest level since April 2000. The news was not as positive from Pending Home Sales, which declined 3.7%, its worst reading in a year.

The Federal Reserve reiterated in its policy statement on Wednesday that it would be ‘”patient'” regarding the timeline for a raise in interest rates, which have been close to zero since 2008. However, the Fed also noted that the US economy was expanding at a ‘”solid pace'” thanks to the robust labor market. This vote of confidence helped the dollar post sharp gains against the euro. The Fed is widely expected to raise rates sometime during the year, so the ‘”Fed rate watch'”is sure to continue as the markets look for clues as to when the Fed will make a move.

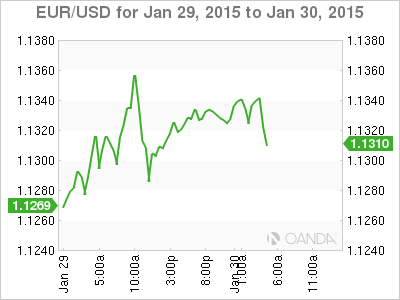

EUR/USD 1.1329 H: 1.1353 L: 1.1304

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.