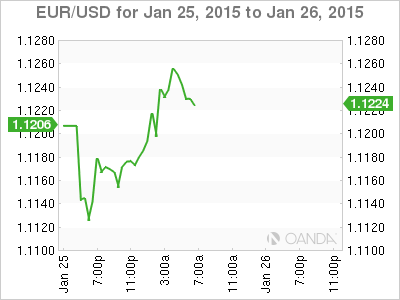

The euro briefly lost ground after Greece announced election results late on Sunday, as the far-left Syriza party won the election. In Monday’s European session, EUR/USD is trading in the mid-1.12 range. On the release front, German Ifo Business Climate improved to 106.7 points, matching the forecast. As well, the Eurogroup finance ministers meet in Brussels. There are no US releases on Monday.

Greeks went to the polls on Sunday, and the far-left Syriza party emerged victorious. Syriza ran on a platform of ending the crushing austerity scheme which Greeks have endured as part of the €240 billion bailout negotiated between and the EU, ECB and IMF. Predictably, the euro fell after the election results, slipping to 1.1099. However, the common currency has stabilized, gaining over 100 points on Monday. Syriza’s win certainly throws a monkey wrench into the Greek bailout program, but the new Greek government is likely to negotiate a deal with Greece’s creditors. A Greek exit from the Eurozone may make for interesting headlines, but such a scenario is extremely unlikely. Indeed, Greek Prime Minister-elect Alexis Tsipras has promised to keep Greece in the Eurozone. Still, there remains plenty of uncertainty as to what will happen with the bailout plan, so traders can expect events in Athens to have a strong impact on the movement of the euro.

There was good news out of Germany to start the week, as the German Ifo Business Climate continued to climb. The key indicator rose to 106.7 points, improving for a third straight month. This was the highest level we’ve seen since July, and points to continuing optimism from the business sector.

The markets had expected the ECB to pull the QE trigger on Thursday, but Mario Draghi has often underwhelmed in his monetary moves, so a QE package worth €1 trillion saw the euro plunge 250 points on Thursday. Under QE, the ECB purchase €60 billion each month, commencing in March and scheduled to last until late 2016. The ECB has been under increasing pressure to combat deflation in the Eurozone, as underscored by a December inflation reading of -0.2%. Thursday’s dramatic move demonstrates a strong determination by the ECB to “take the bull by its horns” in the battle to bolster inflation and kick-start the ailing Eurozone economy.

EUR/USD 1.1227 H: 1.1260 L: 1.1138

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.