Attention will be firmly on the U.S. on Wednesday ahead of the Thanksgiving bank holiday, as we get a broad range of important economic indicators that should offer crucial insight into the health of the U.S. economy.

When considering whether the Federal Reserve will raise interest rates next month, there is naturally a lot of emphasis on the U.S. jobs report as we saw earlier this month and will see again next week. However, there are a number of indicators that the Fed is looking at that can and will influence its decision to either raise rates or hold off until early next year and a number of these will be released today.

While it is difficult to pick the most important among these, the personal consumption expenditure price index surely stands out, given that it is the Fed’s preferred inflation measure. The labour market is looking more than healthy enough to warrant a rate hike, which means all focus in the next few weeks will be on the outlook for inflation. The core reading is expected to show prices rising by 1.3% compared to October last year which is unchanged from September but probably good enough for the Fed to push ahead as planned. Another decline here would worry investors and once again call into question whether the Fed will act.

While current levels of inflation are of course important, the temporary deflationary pressures have forced the Fed to focus more on the outlook and its ability to keep a lid on inflation when it does start rising again, hence the desire to raise even when it’s still well below its target. This makes personal income and spending figures very interesting, both of which are expected to have picked up in October from 0.1% to 0.4% and 0.3%, respectively. Income is particularly important as higher wages tend to be passed on to the end consumer, creating the inflationary pressures the Fed craves.

There are a number of other notable releases today, all of which could influence the Fed decision and therefore could create some volatility in the markets, especially as many of them are released simultaneously. Given how much information that investors have to absorb, we could well see large amounts of volatility initially before markets stabilise and find their levels. Durable goods orders will be among these reports and are expected to bounce back a little following two negative reports, although core orders are expected to remain somewhat subdued which acts as another reminder that this recovery is facing strong headwinds and is likely to continue to stall in the year ahead.

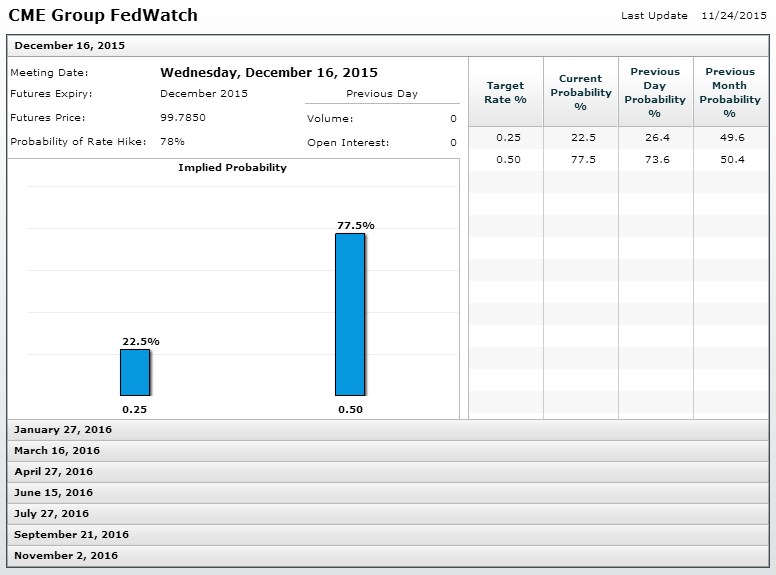

It is worth noting that Fed Funds futures are now pricing in a 78% chance of a rate hike in December, which is extremely high considering that the decision is far from guaranteed and the data has certainly not been perfect.

While I do believe that the rate hike will come in December, the market can be quite fickle and if we see a few disappointing numbers today – which is likely given the inconsistency in the data all year – the question of whether the Fed will/should hike will start all over again.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.