Draghi vows to “do what we must”

ECB President Mario Draghi once again delivered a very dovish message during his speech at Euro Finance Week this morning. His “we will do what we must” comment was almost reminiscent of his “whatever it takes” pledge back in 2012, although of course the latter was far more powerful given the circumstances and no prior warning. The comments today though are still a clear signal to the markets that the ECB intends to provide additional stimulus when it meets in a couple of weeks, the only question now is what will it do and how far will it go?

A cut to the deposit rate looks likely at this stage, as does some form of extension to its quantitative easing program, either through additional purchases, a broader range of instruments or its lifetime. The fact that we’ve seen no reaction to the comments in the equity markets and even some bond yields are higher on the day suggests investors are no wiser on the kind of stimulus the ECB will offer than they were before. However the euro did slide in response to the comments so clearly whatever approach they take is expected to be bold.

EURUSD

The euro fell back below 1.07 against the dollar following Draghi’s comments this morning and while it has pared some of these losses since, we could see further downside as the day goes on. That said, we’ve seen a sizeable sell-off in the pair over the last month and today’s sell-off was not hugely significant which may suggest both ECB easing and Fed tightening is largely priced in. We could be looking at a very overcrowded trade at this stage and the lack of downward momentum, as can be seen on the MACD histogram, may suggest that more significant losses will be hard to come by. Even more hawkish comments from Fed officials today may not give the pair the push it needs to move back towards 1.0450-1.05, this year’s lows.

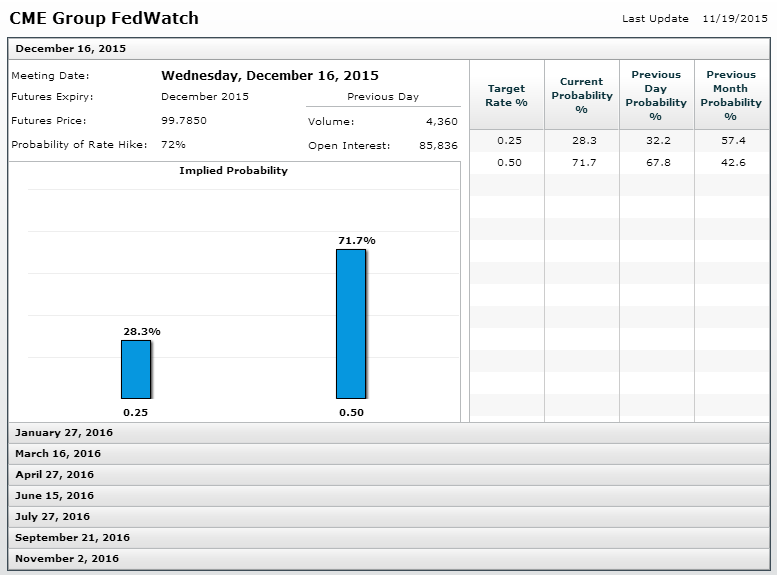

According to Fed Funds futures, a December rate hike is now 72% priced in and I wonder how much higher that can go.

EURGBP

The euro has also come under more pressure against the pound but again, it was not significant enough to force the pair through this week’s 0.70 support, which is proving to be a key psychological level. Clearly plenty of downward pressure remains here but buyers continue to come in at 0.70 and I think it’s going to take something very significant at this stage to break it, possibly an indication of the size of the ECBs stimulus package. Of course this is a two way trade and bullish news for the pound could force the move but I also don’t see this coming today. If the level is broken then the next notable support could come at this year’s lows around 0.6940-0.6950.

The S&P is expected to open 6 points higher, the Dow 64 points higher and the Nasdaq 17 points higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.