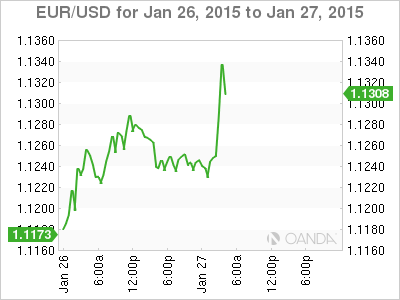

The euro continues to post gains on Tuesday, as EUR/USD trades just above the 1.13 line in the European session. On the release front, there are no Eurozone economic reports. EU finance ministers will meet in Brussels later in the day. It’s a busy day in the US, with three key events on the calendar – Core Durable Goods Orders, CB Consumer Confidence and New Home Sales.

Greece remains the focus of the markets as voters gave a sweeping mandate to the far-left Syriza party. Syriza ran on a platform of ending the crushing austerity scheme which Greeks have endured as part of the €240 billion bailout negotiated between and the EU, ECB and IMF. Predictably, the euro fell immediately after the election results, slipping to the 1.11 line. However, the common currency has recovered nicely, gaining about 100 points on Monday and continuing to move upwards on Tuesday.

Syriza’s win certainly throws a monkey wrench into the Greek bailout program, but the new Greek government is likely to negotiate a deal with Greece’s creditors. A Greek exit from the Eurozone may make for interesting headlines, but such a scenario is extremely unlikely. Indeed, Greek Prime Minister-elect Alexis Tsipras has promised to keep Greece in the Eurozone. Still, there remains plenty of uncertainty as to what will happen with the bailout plan, so traders can expect events in Athens to have a strong impact on the movement of the euro.

The Federal Reserve starts a two-day meeting on Tuesday and will release a policy statement on Wednesday. The Fed to continue to counsel patience regarding an interest rate hike, and persistently weak inflation means the Fed can take its time before having to make a monetary move. The markets will be combing through the statement and any clues as to the timing of rate hike could have a strong effect on the movement of EUR/USD.

EUR/USD 1.1324 H: 1.1345 L: 1.1224

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.