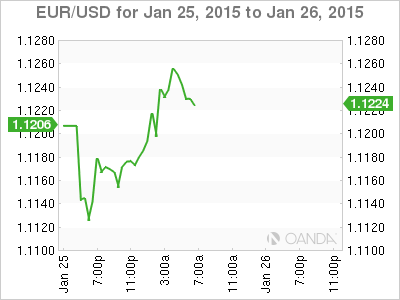

The euro briefly lost ground after Greece announced election results late on Sunday, as the far-left Syriza party won the election. In Monday’s European session, EUR/USD is trading in the mid-1.12 range. On the release front, German Ifo Business Climate improved to 106.7 points, matching the forecast. As well, the Eurogroup finance ministers meet in Brussels. There are no US releases on Monday.

Greeks went to the polls on Sunday, and the far-left Syriza party emerged victorious. Syriza ran on a platform of ending the crushing austerity scheme which Greeks have endured as part of the €240 billion bailout negotiated between and the EU, ECB and IMF. Predictably, the euro fell after the election results, slipping to 1.1099. However, the common currency has stabilized, gaining over 100 points on Monday. Syriza’s win certainly throws a monkey wrench into the Greek bailout program, but the new Greek government is likely to negotiate a deal with Greece’s creditors. A Greek exit from the Eurozone may make for interesting headlines, but such a scenario is extremely unlikely. Indeed, Greek Prime Minister-elect Alexis Tsipras has promised to keep Greece in the Eurozone. Still, there remains plenty of uncertainty as to what will happen with the bailout plan, so traders can expect events in Athens to have a strong impact on the movement of the euro.

There was good news out of Germany to start the week, as the German Ifo Business Climate continued to climb. The key indicator rose to 106.7 points, improving for a third straight month. This was the highest level we’ve seen since July, and points to continuing optimism from the business sector.

The markets had expected the ECB to pull the QE trigger on Thursday, but Mario Draghi has often underwhelmed in his monetary moves, so a QE package worth €1 trillion saw the euro plunge 250 points on Thursday. Under QE, the ECB purchase €60 billion each month, commencing in March and scheduled to last until late 2016. The ECB has been under increasing pressure to combat deflation in the Eurozone, as underscored by a December inflation reading of -0.2%. Thursday’s dramatic move demonstrates a strong determination by the ECB to “take the bull by its horns” in the battle to bolster inflation and kick-start the ailing Eurozone economy.

EUR/USD 1.1227 H: 1.1260 L: 1.1138

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.