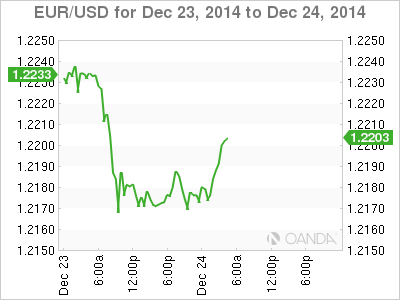

As expected, it’s been an uneventful week for EUR/USD, which is trading at the 1.22 line Wednesday. The euro remains under pressure, as the currency trades at its lowest level since August 2012. German markets will be closed for the rest of the week and there are no releases out of the Eurozone until next week. In the US, today’s highlight is Unemployment Claims. The key indicator is usually released each Thursday, but has been brought forward due to the Christmas holiday. The markets are not expecting much change from the previous release, with the estimate standing at 291 thousand.

In the US, there were a host of key events on Tuesday, with mixed results. GDP was red-hot in Q3, jumping 5.0%, ahead of the estimate of 4.6%. This marked the indicator’s strongest gain since the third quarter of 2003. The US economy is expected to continue to surge in 2015, driven by increased consumer spending and lower oil prices. The news was not as positive from Core Durable Goods Orders, which posted a decline of 0.4%, its fourth decline in five readings. The reading was well off the estimate of 1.1%. Durable Goods Orders looked even worse, with a reading of -0.7%. This surprised the markets which had anticipated a strong gain of 3.0%. Elsewhere in the US, housing data continues to weaken as New Home Sales slipped to 438 thousand, its poorest showing since July and well short of the forecast of 461 thousand. UoM Consumer Sentiment continues to rise, hitting 93.6 points in December. This marked its highest level since February 2007, as the US consumer remains very optimistic about the economy as we move into 2015.

The Eurozone economy continues to struggle with low growth and weak inflation, but recent releases out of Germany, the Eurozone’s largest economy, give room for some optimism. The January forecast for German Consumer Climate came in at 9.0 points, a notch above the estimate of 8.9 points. This marked the fourth straight rise for the indicator, pointing to stronger optimism from consumers as we head into the New Year. These strong numbers come on the heels of German Business Climate, which improved to 105.5 points, up from 104.4 a month earlier. This edged above the forecast of 105.4 points. On the inflation front, German PPI, which tracks manufacturing inflation, improved to 0.0% in November, up from -0.2% a month earlier. Like the consumer confidence indicator, this release is on an upward trend. Strong German consumer and business confidence numbers are welcome news, as the Eurozone economy continues to struggle.

EUR/USD 1.2205 H: 1.2208 L: 1.2169

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.