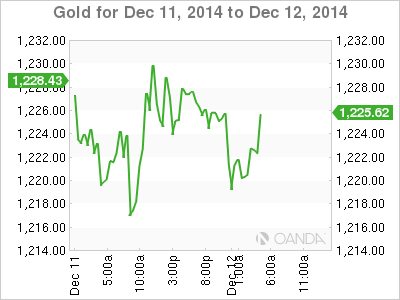

Gold is showing limited movement on Friday, continuing the trend which has marked XAU/USD for most of the week. In the European session, the spot price stands at $1222.41. In the US, there are two major events – Producer Price Index and the UoM Consumer Sentiment. The inflation index is expected to show a small decline, but the markets are anticipating that the consumer confidence report will continue its upward trend.

US retail sales reports, the primary gauge of consumer spending, looked sharp in November. Core Retail Sales came in at 0.5%, ahead of the estimate of 0.1%. Not to be undone, Retail Sales posted a gain of 0.7%, beating the estimate of 0.4%. This was the indicator’s strongest showing in 12 months. There was more good news on the job front, as Unemployment Claims dipped to 294 thousand, below the forecast of 299 thousand.

The euro showed little response to the ECB’s second TLTRO (Targeted Long Term Refinancing Option) on Thursday. This lending program aims to bolster the economy by increasing bank lending to the real economy. The auction in saw European banks take loans of about EUR 130 billion. Although this was higher than the September auction, which had a take-up of EUR 82 billion, the total of around 212 billion was only half of the ECB target of 400 billion. The disappointing figure means that the ECB remains under strong pressure to introduce QE early in 2015, which would likely push the euro to further lows. Meanwhile, the Eurozone continues to struggle with low inflation levels, with a senior ECB official warning of deflation dangers. Speaking in Washington on Tuesday, ECB board member Peter Praet said that falling oil prices could push Eurozone inflation into negative territory.

XAU/USD 1222.41 H: 1226.79 L: 1217.44

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.