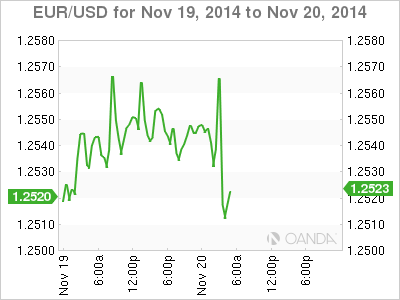

EUR/USD is stable on Thursday, as the pair trades in the low-1.25 range. On the release front, Eurozone PMI data disappointed, as Eurozone and German data weakened in November. On a bright note, French PMIs showed slight improvement. In the US, it’s busy day, with three key indicators – Core Retail Sales, Retail Sales and Unemployment Claims. Any unexpected readings from these events could translate into some volatility from EUR/USD.

Eurozone and German PMIs softened in November, underscoring weakening activity in the manufacturing and services sectors. German Flash Manufacturing PMI dipped to 50.0 points, the separator between contraction and expansion. This marked the first month that the key indicator has failed to show expansion since June 2013. Eurozone Flash Manufacturing followed course, dipping to 50.4 points. This was the lowest reading recorded since June 2013.

Despite the stagnant Eurozone economy, German investor confidence soared in November, as ZEW Economic Sentiment rose to 11.5 points, compared to -3.6 points in the previous release. This crushed the forecast of 0.9 points and marked a 4-month high for the key indicator. It was a similar story with Eurozone ZEW Economic Sentiment, which jumped to 11.0 points, easily beating the estimate of 4.3 points. The thumbs-up from investor confidence followed the news that Germany had avoided a recession with a small 0.1% gain in GDP in Q3.

The ECB hasn’t had much success in kick-starting the ailing Eurozone economy. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank. Speaking before a European parliamentary committee on Monday, Draghi said that QE remains at option. If the ECB does decide to make such a move, the wobbly euro could lose more ground.

EUR/USD 1.2528 H: 1.2574 L: 1.2505

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.