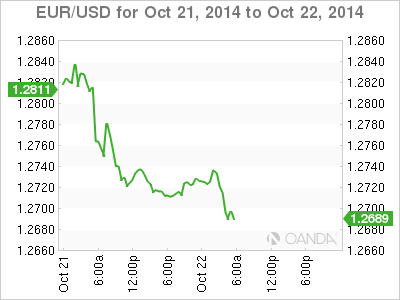

EUR/USD has posted slight losses on Wednesday, as the pair has dropped below the 1.27 line in the European session. The euro remains under pressure, having lost over 100 points since early Tuesday. On the release front, there are no major Eurozone releases on the schedule. In the US, today’s highlight is Core CPI and CPI. The markets are keeping expectations low for the September readings.

Despite the efforts of the ECB, inflation levels in the Eurozone remain anemic, as German PPI came in at a flat 0.0%, shy of the estimate of 0.1%. The indicator has not produced a gain since December, as Germany continues to struggle with a lack of inflation. Eurozone Current Account, which is closely linked to currency demand, posted a surplus of EUR 18.9 billion, little changed from the previous release of EUR 18.7 billion. This reading disappointed the markets, as the estimate stood at EUR 21.3 billion.

The Deutsche Bundesbank issued its monthly report on Monday. The German central bank said that the economy showed little growth in the third quarter, as manufacturing production fell and business confidence weakened. At the same time, employment numbers and consumer spending were higher, so GDP was likely to remain unchanged. As for Q4, the report stated that the outlook is “moderate”. The report underscores weakness in the German economy, long considered the locomotive of Europe. The euro is sensitive to German data, so weak German numbers could hurt the shaky euro.

EUR/USD 1.2692 H: 1.2740 L: 1.2681

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.