EUR/USD is stable on Monday, as the pair trades in the mid-1.28 range in the European session. The euro had a bad week and lost about 130 points, as the currency finds itself close to 14-month lows against the surging US dollar. In the Eurozone, there are no data releases on Monday. The markets will be listening closely as ECB head Mario Draghi testifies before the European Parliament Economic and Monetary Committee in Brussels. In the US, today's only data release is Existing Home Sales.

Eurozone inflation numbers continue to float at anemic levels. On Friday, German PPI posted a decline of -0.1%, unchanged from the previous reading. The index has not managed a gain in 2014. Meanwhile, in an effort to combat deflation in the Eurozone, the ECB announced the results of its first TLTRO on Thursday. This lending program aims to bolster the economy by increasing bank lending to the real economy. The ECB said that the take-up by European banks amounted to 82.3 billion euros, which was well short of estimates that ranged from 100-300 billion. Still, it's too early to declare the program a failure, and traders and investors will have to wait till the next TLTRO in December before reaching conclusions as to the scheme's success.

The US economy may be much more robust than that of the Eurozone, but it is also affected by weak inflation levels. CPI, the primary gauge of consumer inflation, came in at -0.2%, its first drop since October. The estimate stood at +0.1%. Core CPI followed suit with a flat reading of 0.0%. This was the first time the index failed to post a gain since October 2010. The weak numbers follow disappointing manufacturing inflation data. PPI, a key event, dipped to just 0.0%, a 3-month low. The estimate stood at 0.1%. Core PPI slipped to 0.1%, down from 0.2% a month earlier. This matched the forecast. Low inflation continues to be a concern and could delay an interest rate hike in 2015.

Last week, the dollar posted sharp against the euro after the Federal Reserve policy statement. The Fed reaffirmed that interest rates would remain ultra-low for a "considerable time" after its asset purchase scheme (QE) ends next month, but surprised the markets in hinting that once a rate hike was introduced, rate levels could move up more quickly than expected. As expected, the Fed trimmed QE by $10 billion/month, and the remaining $15 billion/month is scheduled to be phased out in October.

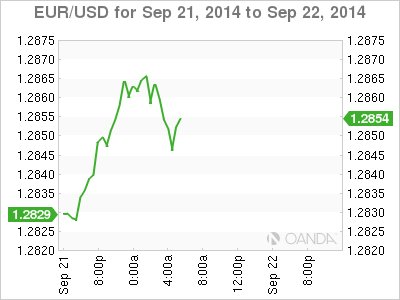

EUR/USD 1.2853 H: 1.2868 L: 1.2839

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price on the defensive, amid soft US Dollar

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.