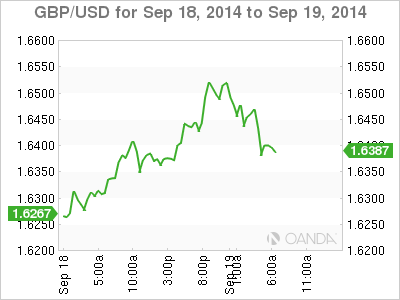

The pound is treating traders to strong volatility on Friday. GBP/USD pushed above the 1.65 level in the Asian session but has since fallen below the 1.64 line. The currency received a boost after the results of the Scottish referendum were released, which showed a decisive victory for the NO camp, which favored remaining in the United Kingdom. It's a quiet day on the release front, with no UK events. The sole US release is the CB Leading Index, a minor event.

Scottish citizens went the polls on Thursday in a historic referendum on whether to secede from the United Kingdom. The markets had expected a very close vote, based on polls leading up to the vote. However, at the end of the day, the No side won the vote in convincing fashion, with 55% of the vote, versus 44% for the Yes side. There had been predictions of a financial downturn in the UK if Scotland had voted for independence or if the vote was extremely close. As well, a vote for to secede would have raised thorny economic issues such as what currency would be used by an independent Scotland. So, the wee hours of Friday morning brought a tremendous sense of relief in British political and financial circles after the final votes were counted, as the United Kingdom will indeed remain united.

Overshadowed by the focus on the Scottish referendum, British data was a mix on Thursday. British Retail Sales, the primary gauge of consumer spending in the UK, improved last month, posting a gain of 0.4%. However, CBI Industrial Order Expectations came in at -4 points, the worst showing since last September. The markets had expected a gain of 9 points.

Over in the US, Unemployment Claims had looked sluggish in September, but that changed on Thursday, as the key indicator sparkled, dropping to 280 thousand, down sharply from 315 thousand in the previous reading. The estimate stood at 312 thousand. Building Permits was not as strong, dipping to 1.00M. This was shy of the estimate of 1.04M. There was disappointing news from the manufacturing front, as the Philly Fed Manufacturing Index slipped to 22.5 points, down from 28.0 a month earlier. The estimate stood at 22.8 points.

The Federal Reserve released a highly-anticipated policy statement on Wednesday. The statement reaffirmed that interest rates would remain ultra-low for a "considerable time" after the asset purchase scheme (QE) ends next month, but surprised the markets in hinting that once a rate hike was introduced, rate levels could move up more quickly than expected. As expected, the Fed trimmed QE by $10 billion/month, and the remaining $15 billion/month is scheduled to be phased out in October.

GBP/USD 1.6381 H: 1.6524 L: 1.6353

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.