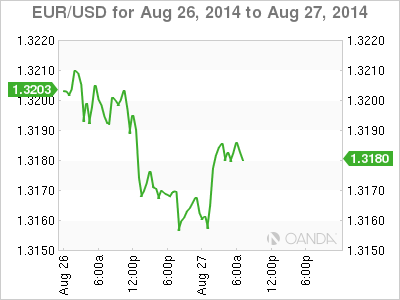

It continues to be a quiet week for EUR/USD, which is trading in the high-1.31 range in Wednesday's European session. On the release front, there are no major releases out of the Eurozone or the US. There was more weak data out of Germany, as GfK German Consumer Climate came in at 8.6 points, marking a three-month low.

Germany is supposed to be the Eurozone's reliable locomotive, but the region's largest economy is showing signs of weakness. On Wednesday, GfK Consumer Climate came in at 8.6 points, short of the estimate of 8.9. It was a disappointing result compared to the June reading of 9.0 points. Earlier in the week, German Ifo Business Climate dropped to 106.3 points, its lowest reading since June 2013. This follows the Services and Manufacturing PMIs, both of which softened in July. The markets are bracing for more bad news, with a weak release expected from German Preliminary CPI on Thursday.

US durables painted a mixed picture on Tuesday. Core Durable Goods Orders, a key indicator, came in at -0.8%, its worst showing in 2014. This was nowhere near the estimate of +0.5%. At the same time, Durable Goods Orders stunned the markets with a record gain of 22.6%. The reason? A huge increase in the purchase of passenger planes in July. Meanwhile, the CB Consumer Sentiment jumped to 92.4 points, up from 90.3 a month earlier.

Financial leaders and central bankers met at Jackson Hole for a conference late last week, and the markets were all ears as Fed chair Janet Yellen delivered the keynote address on Friday. Any hopes for some dramatic news were dashed, as Yellen did not provide any clues as to the timing of a rate hike. She reiterated that the US job market still needed to improve, so employment numbers remain a crucial factor in any rate move by the Fed. There is a divergence in monetary stance between the ECB and the Fed, as the Fed is winding up QE, while the ECB may be forced to provide stimulus to the prop up the sagging Eurozone economy.

EUR/USD 1.3182 H: 1.3289 L: 1.3153

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.