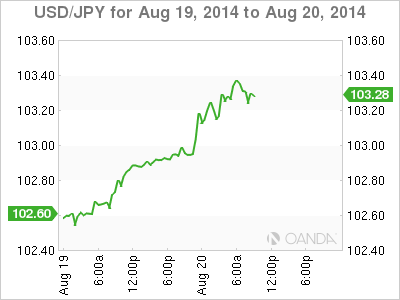

The US dollar continues to gain ground against the Japanese yen, as USD/JPY trades in the mid-103 range early in the North American session. In Japan, All Industries Activities, a minor event, posted a -0.4% decline and missed expectations.

All eyes are on the Federal Reserve, which will release the minutes of its last policy meeting later on Wednesday. Traders looking for clues as to when the Fed will press the trigger and raise interest rates, but Fed chair Janet Yellen might not oblige. US growth numbers have been positive, but job data could be better and inflation remains very low. The Fed's asset purchase program (QE) is scheduled to wind up in October, and a rate hike appears to be a question of timing.

The US economy has been moving in the right direction, but inflation numbers in the US remain at very low levels. On Tuesday, CPI and Core CPI, the primary gauges of consumer inflation, both posted paltry gains of 0.1%. These weak readings come on the heels of PPI, a manufacturing inflation index, which also came in at 0.1% last month. Weak inflation is one reason why the Federal Reserve is in no rush to raise interest rates, as low inflation points to slack in the economy. Meanwhile, US housing numbers were sharp on Tuesday. Building Permits improved to 1.05 million, beating the estimate of 1.00 million. Housing Starts jumped to 1.09 million, easily beating the estimate of 0.97 million.

Financial leaders and central bankers from around the world will gather in Jackson Hole, Wyoming for a conference which starts on Friday. This will be Janet Yellen's first appearance as Fed chair at the conference, and will undoubtedly be the star of the show. Yellen is expected to discuss the employment market rather than monetary policy, but the markets will be listening closely for any hints as to an interest rate hike.

USD/JPY 103.31 H: 103.40 L: 102.90

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.