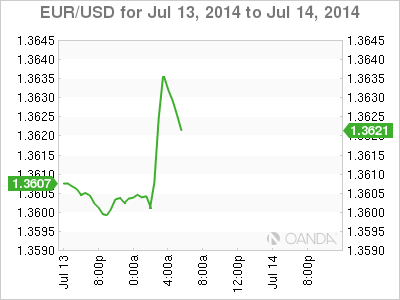

EUR/USD has posted slight gains on Monday, as the pair trades in the low-1.36 range in the European session. Monday has a very light schedule. In the Eurozone, German Industrial Production posted its sharpest decline in two years. As well, ECB Mario Draghi will testify at the Committee on Economic and Monetary Affairs of the European Parliament. There are no US releases to start off the week.

In the US, employment data continues to impress. Last week, Unemployment Claims dropped to 304 thousand, well below the estimate of 316 thousand. Employment numbers for June looked sharp, led by a jump in Nonfarm Payrolls and a drop in the unemployment rate. The strong employment numbers have increased speculation about an interest rate hike by the Federal Reserve, and remarks by Fed policymakers will be closely scrutinized as the markets look for clues as to the timing of any rate moves.

The Federal Reserve minutes did not shed much light on when the Fed plans to raise interest rates, but policymakers did agree to wind up the QE scheme by October. The asset purchase program flooded the economy with over $2 trillion, and the Fed has been steadily reducing the program since last December. Winding down QE, which currently stands at $45 billion/month, will require several more tapers by the Fed, but that shouldn't pose a problem, given the solid employment data the economy has been churning out.

The ECB cut interest rates in June, hoping to inject some life into growth and inflation levels. So far, the results have been less than impressive. On Monday, German Industrial Production plunged 1.2%, and last week's manufacturing numbers out of Germany, Italy and France were dismal, with all three posting sharp declines. Inflation numbers have also remained weak. French CPI posted a flat reading of 0.3%, missing the estimate of 0.2%. In Germany, Final CPI came in at 0.3%, matching the forecast. German WPI slipped by 0.1%, its second straight decline. A strong euro has not helped matters, as it makes European exports more expensive and weighs on growth. If the trend of weak figures continues, the ECB will face more pressure to take action at its next policy meeting.

EUR/USD 1.3629 H: 1.3640 L: 1.3598

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.