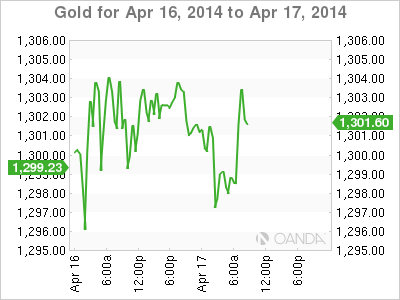

Gold prices are steady on Thursday, as the spot price is just above the key $1300 level late in the European session. In economic news, US Unemployment Claims were steady and beat the estimate. Later in the day, we'll get a look at another key event, with the release of the Philly Fed Manufacturing Index.

In the US, Unemployment Claims had another strong release, coming in at 304 thousand. This was well below the estimate of 316 thousand, and marked the second straight week that the key indicator beat the estimate. With the Federal Reserve saying that further trims to QE will depend on the health of the employment market, employment numbers have taken on added significance.

The US dollar is broadly lower following dovish comments by Federal Reserve chair Janet Yellen on Wednesday. Yellen said there is little inflationary pressure on the economy, and it was unlikely that the Fed's inflation target of 2% would be met. She added that although the economy has showed signs of recovery, unemployment remains a sore spot. The Fed has abandoned its promise to maintain interest rates at least as long as the unemployment rate is above 6.5%, but the dovish stance we are seeing from Yellen means that a rate hike is unlikely in the near future.

Tensions between East and West continue over the volatile situation in Ukraine. There have been several skirmishes between pro-Russian militiamen and Ukrainian forces, and casualties have been reported on both sides. Secretary of State John Kerry and his Russian counterpart are meeting on Thursday, but a quick resolution is unlikely. Western Europe is dependent on Russian oil and gas, so we could see some market movement as the crisis continues.

XAU/USD 1300 H: 1304 L: 1296

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.