USD/JPY is almost unchanged on Friday, as USD/JPY is trading slightly above the 120 line. Japanese markets were open on Christmas Day, and there were a host of Japanese releases, led by inflation and consumer spending reports. On Friday, the sole Japanese release, Average Cash Earnings, missed expectations with a decline of 1.5%. There are no US releases on Friday.

With US and European markets closed on Thursday, the spotlight shifted to Japan, which released a batch of key events. Tokyo Core CPI, the key inflation indicator, edged down to 2.3% in November, matching the market forecast. However, the indicator continued a worrying downward trend, dropping for a fourth straight week. Consumer demand remains weak, as Household Spending posted a sharp decline of 2.5%. Retail Sales posted a gain of 0.4%, but this was well short of the forecast of 1.2% and the weakest showing since June. There was no relief from the manufacturing front, as Preliminary Industrial Production fell by 0.6%, well short of the estimate of a 1.0% gain. The weak numbers paint a grim picture of the health of the Japanese economy as we head into 2o15. Prime Minister Abe, armed with a fresh mandate after recent elections, is under strong pressure to reinvigorate economic activity and is expected to unveil new stimulus measures on Saturday.

In the US, there were a host of key events on Tuesday, with mixed results. GDP was red-hot in Q3, jumping 5.0%, ahead of the estimate of 4.6%. This marked the indicator’s strongest gain since the third quarter of 2003. The US economy is expected to continue to surge in 2015, driven by increased consumer spending and lower oil prices. The news was not as positive from Core Durable Goods Orders, which posted a decline of 0.4%, its fourth decline in five readings. The reading was well off the estimate of 1.1%. Durable Goods Orders looked even worse, with a reading of -0.7%. This surprised the markets which had anticipated a strong gain of 3.0%. UoM Consumer Sentiment continues to rise, hitting 93.6 points in December. This marked its highest level since February 2007, as the US consumer remains very optimistic about the economy as we move into 2015.

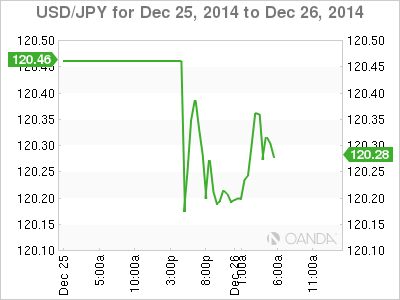

USD/JPY 120.28 H: 120.43 L: 120.15

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.