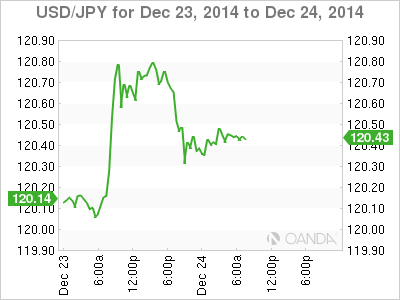

USD/JPY is stable on Wednesday, as USD/JPY is trading in the mid-120 range. In the US, today’s highlight is Unemployment Claims. The key indicator is usually released each Thursday, but has been brought forward due to the Christmas holiday. The markets are not expecting much change from the previous release, with the estimate standing at 291 thousand. Over in Japan, the BOJ will release the minutes of last week’s policy meeting as well as the Services Producer Price Index, which measures corporate inflation.

In the US, there were a host of key events on Tuesday, with mixed results. GDP was red-hot in Q3, jumping 5.0%, ahead of the estimate of 4.6%. This marked the indicator’s strongest gain since the third quarter of 2003. The US economy is expected to continue to surge in 2015, driven by increased consumer spending and lower oil prices. The news was not as positive from Core Durable Goods Orders, which posted a decline of 0.4%, its fourth decline in five readings. The reading was well off the estimate of 1.1%. Durable Goods Orders looked even worse, with a reading of -0.7%. This surprised the markets which had anticipated a strong gain of 3.0%.

Elsewhere in the US, housing data continues to weaken as New Home Sales slipped to 438 thousand, its poorest showing since July and well short of the forecast of 461 thousand. UoM Consumer Sentiment continues to rise, hitting 93.6 points in December. This marked its highest level since February 2007, as the US consumer remains very optimistic about the economy as we move into 2015.

Japanese Prime Minister was re-elected by parliament on Wednesday and can now get back to the tough task of tackling the sluggish Japanese economy. Abe billed the election as a mandate on his “Abenomics” platform, which has included radical monetary easing and more government spending. The government’s economic platform has eliminated deflation, but the yen has plummeted as it trades around the 120 level. The weak yen has curtailed domestic demand, which has also been hurt by a sales tax hike which was introduced earlier in the year.

USD/JPY 120.44 H: 120.71 L: 120.28

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.