EUR/USD is steady on Tuesday, as the pair trades in the mid-1.24 range in the European session. On the release front, it’s a busy day in the Eurozone. German Manufacturing PMI improved to 51.4 points, and the Eurozone reading improved to 50.8 points. Later in the day, we’ll get a look at German ZEW Economic Sentiment and Eurozone CPI. In the US, today’s major events are Building Permits and Housing Starts.

There was some good news on the Eurozone manufacturing front, as German Manufacturing PMI improved to 51.2 points, up from 50.0 points a month earlier. A reading above the 50-point level indicates expansion. The Eurozone released improved to 50.8 points, up from 50.4 points. French Manufacturing PMI showed little change, coming in at 47.9 points. The index has been under 50 since April, indicative of ongoing contraction. Services PMIs were mixed, as the German release weakened, while the Eurozone and French readings improved.

The US ended last week with mixed news, as inflation dipped while consumer confidence jumped. The Producer Price Index, the primary gauge of manufacturing inflation, dropped by 0.2%, its worst showing in six months. The estimate stood at -0.1%. Meanwhile, UoM Consumer Sentiment moved higher for a fourth straight month, pointing to increased optimism among US consumers. The key indicator soared to 93.8 points, its highest level since January 2007 and well above the forecast of 89.6 points. There was more good news from retail sales and jobless claims. Core Retail Sales came in at 0.5%, ahead of the estimate of 0.1%. Not to be undone, Retail Sales posted a gain of 0.7%, beating the estimate of 0.4%. This was the indicator’s strongest showing in 12 months. There was more good news on the job front, as Unemployment Claims dipped to 294 thousand, below the forecast of 299 thousand.

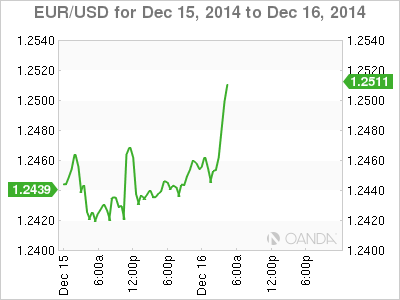

EUR/USD 1.2476 H: 1.2481 L: 1.2435

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.