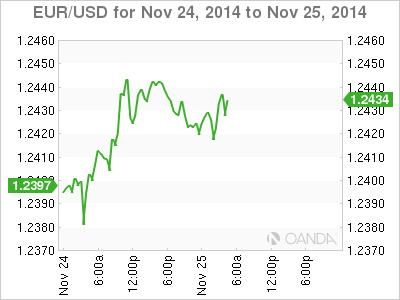

EUR/USD is very quiet on Tuesday, as the pair trades in the mid-1.24 range in the European session. On the release front, German GDP posted a weak gain of 0.1%, matching the forecast. In the US, there are two key events on the schedule – Preliminary GDP and CB Consumer Confidence.

The euro hasn’t had much to cheer about lately, and the currency took a tumble on Friday, losing over 150 points. This was a result of remarks from ECB head Mario Draghi, who warned that that inflation expectations were declining to levels that were very low and said the ECB is ready to expand its stimulus program. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank.

All eyes are on US GDP for Q3, which will be released later on Tuesday. The markets are expecting a strong gain of 3.3%. This is not as strong as the Q2 release, which posted a gain of 4.2%. If the indicator meets or exceeds expectations, we could see the US dollar post gains in the North American session.

EUR/USD 1.2434 H: 1.2444 L: 1.2416

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.