Gold has posted modest gains on Thursday, recovering losses sustained a day earlier. On the release front, it’s a very busy day, with four key indicators – Core CPI, CPI, Unemployment Claims and the Philly Fed Manufacturing Index. Any unexpected readings from these events could translate into some volatility from EUR/USD.

The Federal Reserve released its minutes on Wednesday and there were no clues about the timing of a rate hike. The markets are expecting rates to rise in the second half of 2015, but this will of course depend on economic conditions. With inflation below the Fed target of 2%, there is less pressure to raise rates. The minutes also noted that that weak economic outlooks in Europe and Japan are unlikely to have a negative impact on the US economy.

The ECB hasn’t had much success in kick-starting the ailing Eurozone economy. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank. Speaking before a European parliamentary committee on Monday, Draghi said that QE remains at option. If the ECB does decide to make such a move, the wobbly euro could lose more ground.

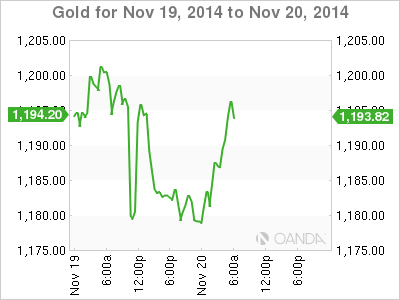

XAU/USD 1192.79 H: 1197.13 L: 1176.82

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.