EUR/USD is stable on Thursday, as the pair trades in the low-1.25 range. On the release front, Eurozone PMI data disappointed, as Eurozone and German data weakened in November. On a bright note, French PMIs showed slight improvement. In the US, it’s busy day, with three key indicators – Core Retail Sales, Retail Sales and Unemployment Claims. Any unexpected readings from these events could translate into some volatility from EUR/USD.

Eurozone and German PMIs softened in November, underscoring weakening activity in the manufacturing and services sectors. German Flash Manufacturing PMI dipped to 50.0 points, the separator between contraction and expansion. This marked the first month that the key indicator has failed to show expansion since June 2013. Eurozone Flash Manufacturing followed course, dipping to 50.4 points. This was the lowest reading recorded since June 2013.

Despite the stagnant Eurozone economy, German investor confidence soared in November, as ZEW Economic Sentiment rose to 11.5 points, compared to -3.6 points in the previous release. This crushed the forecast of 0.9 points and marked a 4-month high for the key indicator. It was a similar story with Eurozone ZEW Economic Sentiment, which jumped to 11.0 points, easily beating the estimate of 4.3 points. The thumbs-up from investor confidence followed the news that Germany had avoided a recession with a small 0.1% gain in GDP in Q3.

The ECB hasn’t had much success in kick-starting the ailing Eurozone economy. Deep interest rate cuts haven’t boosted growth or inflation, so the ECB has reached deeper into its toolbox and purchased covered bonds and asset-backed securities. So far, these purchases have been from the private sector, but the ECB could decide to expand these purchases to government bonds, known has quantitative easing (QE). However, there is strong resistance to QE from national central banks, such as the powerful German Bundesbank. Speaking before a European parliamentary committee on Monday, Draghi said that QE remains at option. If the ECB does decide to make such a move, the wobbly euro could lose more ground.

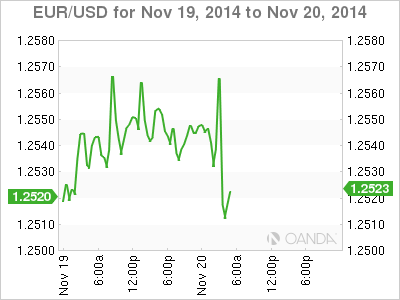

EUR/USD 1.2528 H: 1.2574 L: 1.2505

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.