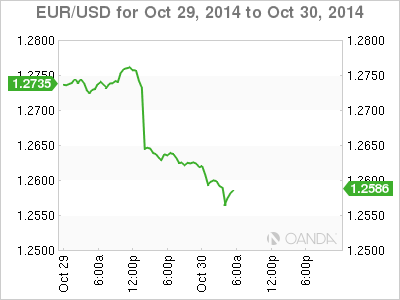

EUR/USD has posted slight losses on Thursday, as the pair trades below the 1.26 in the European session. In the Eurozone, German Unemployment Change was excellent, with a reading of -22 thousand. Later in the day, we’ll get a look at German CPI, which is expected to post a decline of 0.1%. In the US, today’s highlights are US GDP and Unemployment Claims. Both indicators are expected to post strong figures, so we could see the dollar post gains later in the North American session. As well, Federal Reserve Chair Janet Yellen will address an event in Washington.

The euro is sensitive to German numbers, as Germany is the locomotive of Europe and the largest economy in the Eurozone. Unemployment Change was unexpectedly strong, with a contraction of 22 thousand in September. The estimate stood at 4 thousand. German inflation numbers have been very soft, and German CPI, a key indicator is expected to post a weak reading of -0.1%.

The US dollar gained about 100 points on Wednesday, boosted by a hawkish Fed policy statement. The Fed said that the labor market is strengthening and inflation remains on target, although it did note that the labor market participation rate remains low. As expected the Fed completed the taper of its QE3 program. The asset-purchase program was initially started in 2008, at the height of the economic crisis, in order to boost a weak US economy. The termination of the QE is a symbolic step which is a vote of confidence from the powerful Fed that the US economy is on the right track.

US durable goods looked dismal in September. Core Durable Goods Orders dropped 0.2%, its second decline in three months. This was well short of the estimate of 0.5%. Durable Goods Orders followed suit with a decline of -1.3%. This was a second straight decline, and missed the estimate of 0.4%. There was much better news from CB Consumer Confidence, as the indicator climbed to 94.5 points, up sharply from 86.0 points. The easily beat the estimate of 87.4 and marked a 7-year high.

EUR/USD 1.2587 H: 1.2633 L: 1.2655

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.