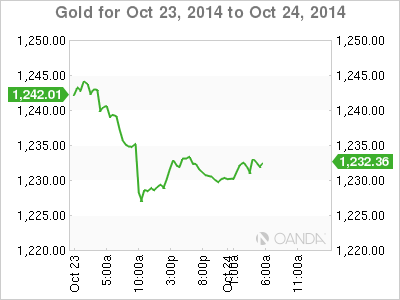

Gold lost ground on Thursday, losing close to 1% of its value against the US dollar. On Friday, the metal’s spot price stands at $1231.80 per ounce in the European session. Although Unemployment Claims rose to 284,000, the four-week average was down sharply. This improvement helped push gold lower against the dollar. On Friday, the sole release on the schedule is New Home Sales. The markets are expecting the indicator to soften this month, with an estimate of 473 thousand.

US Unemployment Claims rose to 284 thousand last week, much higher than the previous reading of 264 thousand. However, the markets were not too concerned, as the four-week average, which is less volatile than the weekly release, dipped to 281,000, a 14-year low. Meanwhile, weak inflation levels continue to point to slack in the economy. On Wednesday, this trend continued with soft consumer inflation numbers. CPI rose to +0.1%, an improvement from the previous reading of -0.2%. The estimate stood at 0.0%, so the markets clearly did not have high expectations. It was a similar story from Core CPI, which also posted a 0.1% gain, up from 0.0% a month earlier. This was shy of the forecast of 0.2% but still within expectations.

On Friday, we’ll get a look at New Home Sales. The indicator shined last month, jumping to 504 thousand, up from 412 thousand in the previous reading. The markets are expecting a downturn in the upcoming release, with an estimate of just 473 thousand. Will the indicator beat this estimate? Earlier in the week, Existing Home Sales sparkled at 5.29 million, its best showing in a year.

XAU/USD 1231.80 H: 1234.18 L: 1229.01

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.