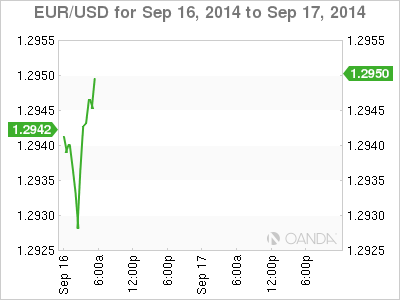

The euro continues to show little movement this week. On Tuesday, EUR/USD is trading in the mid-1.29 range. On the release front, the German and Eurozone investor confidence indicators softened in August. In the US, today's highlight is the Producer Price Index, the first major US event of the week. The markets are expecting a small gain of 0.1%, which would be unchanged from the previous reading.

The news out of the Eurozone remains grim, as German ZEW Economic Confidence, a key event, slipped to 6.9 points last month. The indicator has now dropped over nine consecutive months, down from a high of 62.0 points back in November. Eurozone ZEW Economic Sentiment followed a similar downturn, coming in at 14.2 points, its eighth straight decline. The German indicator managed to beat the estimate of 5.2 points, but the Eurozone figure was well short of the forecast of 21.3 points. The weak data points to crumbling confidence in the German and Eurozone economies, which does not bode well for the slumping euro.

US numbers wrapped up last week on a high note. Core Retail Sales improved to 0.3%, edging above the estimate of 0.2%. Retail Sales posted a nice gain of 0.6%, well above the estimate of 0.3%. There was excellent news from the UoM Consumer Sentiment, which bounced back from a weak reading in July and improved to 84.6 points, its best showing since November 2012. The forecast stood at 83.2 points. These indicators point to an increase in consumer confidence and spending, which underscore a deepening economic recovery.

US job numbers continue to be source of concern. Unemployment Claims rose to 315 thousand, the largest number of claims in 10 weeks. The reading was much higher than the estimate of 306 thousand. This follows soft numbers from JOLTS Job Openings and a dismal Nonfarm Payrolls last week. The troubling job numbers are unlikely to affect the Fed's plan to continue trimming QE later this week, but a soft labor market could postpone plans to raise interest rates by mid-2015.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.