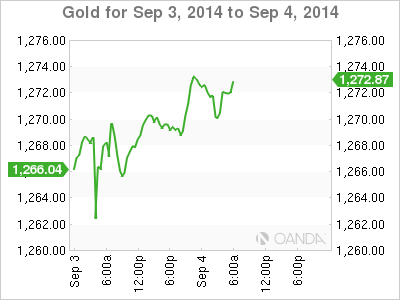

Gold is stable on Thursday, with a spot price of at $1272.14 per ounce. In the Eurozone, the ECB meets later in the day and is expected to maintain its minimum bid rate at 0.15%. In the US, there are four key releases on the schedule - ADP Nonfarm Payrolls, Trade Balance, Unemployment Claims and the ISM Non-Manufacturing PMI.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, Ukrainian President Petro Poroshenko on Wednesday announced a cease-fire in eastern Ukraine. Whether the latest attempt at a truce will last, however, is doubtful. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces are involved in the fighting. The crisis has severely strained relations between the West and Russia, and if the situation deteriorates, gold prices could move higher.

US numbers continue to impress the markets. On Tuesday, ISM Manufacturing PMI impressed the markets, climbing to 59.0 points, its best showing since April 2011. The index easily beat the estimate of 57.0 points. The strong showing follows an unexpectedly strong GDP, which hit 4.2%. With the US economy moving forward at a fast clip, the US dollar has responded with strong gains against gold. Employment data will be in the spotlight for the remainder of the week, with the release of ADP Nonfarm Payrolls and Unemployment Claims on Thursday, followed by the official Nonfarm Payrolls and the unemployment rate on Friday.

XAU/USD 1272.14 H: 1273.46 L: 1267.90

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.