It continues to be a quiet week for EUR/USD, which is trading in the high-1.31 range in Wednesday's European session. On the release front, there are no major releases out of the Eurozone or the US. There was more weak data out of Germany, as GfK German Consumer Climate came in at 8.6 points, marking a three-month low.

Germany is supposed to be the Eurozone's reliable locomotive, but the region's largest economy is showing signs of weakness. On Wednesday, GfK Consumer Climate came in at 8.6 points, short of the estimate of 8.9. It was a disappointing result compared to the June reading of 9.0 points. Earlier in the week, German Ifo Business Climate dropped to 106.3 points, its lowest reading since June 2013. This follows the Services and Manufacturing PMIs, both of which softened in July. The markets are bracing for more bad news, with a weak release expected from German Preliminary CPI on Thursday.

US durables painted a mixed picture on Tuesday. Core Durable Goods Orders, a key indicator, came in at -0.8%, its worst showing in 2014. This was nowhere near the estimate of +0.5%. At the same time, Durable Goods Orders stunned the markets with a record gain of 22.6%. The reason? A huge increase in the purchase of passenger planes in July. Meanwhile, the CB Consumer Sentiment jumped to 92.4 points, up from 90.3 a month earlier.

Financial leaders and central bankers met at Jackson Hole for a conference late last week, and the markets were all ears as Fed chair Janet Yellen delivered the keynote address on Friday. Any hopes for some dramatic news were dashed, as Yellen did not provide any clues as to the timing of a rate hike. She reiterated that the US job market still needed to improve, so employment numbers remain a crucial factor in any rate move by the Fed. There is a divergence in monetary stance between the ECB and the Fed, as the Fed is winding up QE, while the ECB may be forced to provide stimulus to the prop up the sagging Eurozone economy.

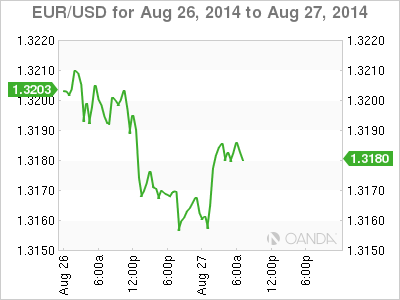

EUR/USD 1.3182 H: 1.3289 L: 1.3153

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.