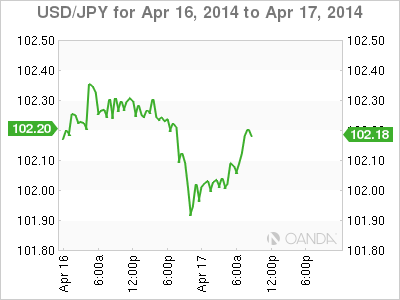

The Japanese yen is trading quietly in Thursday trading, as USD/JPY trades slightly above the 102 level. In economic news, US Unemployment Claims were solid and easily surpassed expectations. In Japan, BOJ Governor Haruhiko Kuroda spoke at an event in Tokyo. Consumer Confidence continues to drop and Tertiary Industry Activity will be released later in the day.

In the US, Unemployment Claims had another strong release, coming in at 304 thousand. This was well below the estimate of 316 thousand, and marked the second straight week that the key indicator beat the estimate. With the Federal Reserve saying that further trims to QE will depend on the health of the employment market, employment numbers have taken on added significance.

On Wednesday, Federal Reserve chair Janet Yellen said that there is little inflationary pressure on the economy, and it was unlikely that the Fed's inflation target of 2% would be met. She added that although the economy has showed signs of recovery, unemployment remains a sore spot. The Fed has abandoned its promise to maintain interest rates at least as long as the unemployment rate is above 6.5%, but the dovish stance we are seeing from Yellen means that a rate hike is unlikely in the near future.

Tensions between East and West continue over the volatile situation in Ukraine. There have been several skirmishes between pro-Russian militiamen and Ukrainian forces, and casualties have been reported on both sides. Secretary of State John Kerry and his Russian counterpart are meeting on Thursday, but a quick resolution is unlikely. Western Europe is dependent on Russian oil and gas, so we could see some market movement as the crisis continues.

USD/JPY 102.14 H: 102.27 L: 101.87

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.