Last Update At 18 Sep 2014 00:35GMT

Trend Daily Chart

Down

Daily Indicators

Rising fm o/s

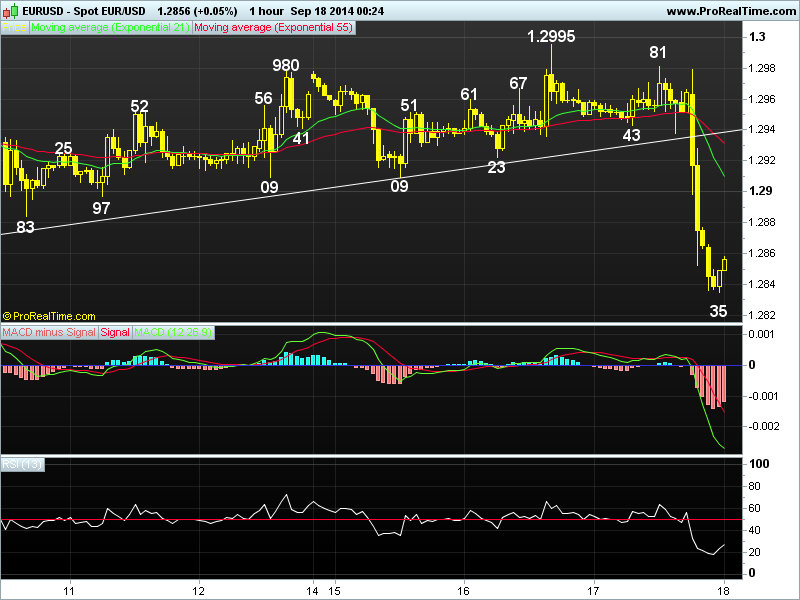

21 HR EMA

1.2910

55 HR EMA

1.2935

Trend Hourly Chart

Down

Hourly Indicators

Rising fm o/s

13 HR RSI

28

14 HR DMI

-ve

Daily Analysis

Resumption of MT downtrend

Resistance

1.2943 - Y'day's Euroepan morning low

1.2909 - Last Fri's n Mon's low

1.2860 - Last Tue's low (now res)

Support

1.2835 - Intra-day low (Australia)

1.2772 - 61.8% proj. of 1.3221-1.2860 fm 1.2995

1.2745 - Apr 2013 low

. EUR/USD - 1.2858... Despite euro's brief bounce fm 1.2943 to 1.2981 in NY morning after the release of lower-than-expected US CPI data, the single currency nose-dived to 1.2898 after the release of dovish Fed's policy statement n price later weakened to a fresh 14-month trough of 1.2835 in Australia.

. Looking at the hourly n daily charts, y'day's of last Tue's 1.2860 low to 1.2835 confirms MT downtrend fm May's 2-1/2 year peak at 1.3995 to retrace entire LT rise fm 2012 bottom at 1.2042 (Jul) has once again resumed n further weakness to 1.2790/95 is now envisaged after minor consolidation, however, as the hourly oscillators' readings are in oversold territory, reckon 1.2788, being 61.8% proj. of intermediate fall fm 1.3221-1.2860 measured fm 1.2995 wud limit downside n yield a much-needed rebound later. Looking ahead, euro is poised to re-test of previous daily sup at 1.2745 (Apr 2013) later this month n only abv 1.2909 signals at temp. low is made n may risk stronger retrace. twd 1.2985/95.

. Today, in view of abv bearish analysis, selling euro on intra-day recovery is the way to go as 1.2880/90 shud cap upside, however, profit shud be taken on subsequent decline.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.