Last Update At 18 Aug 2014 00:07GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning up

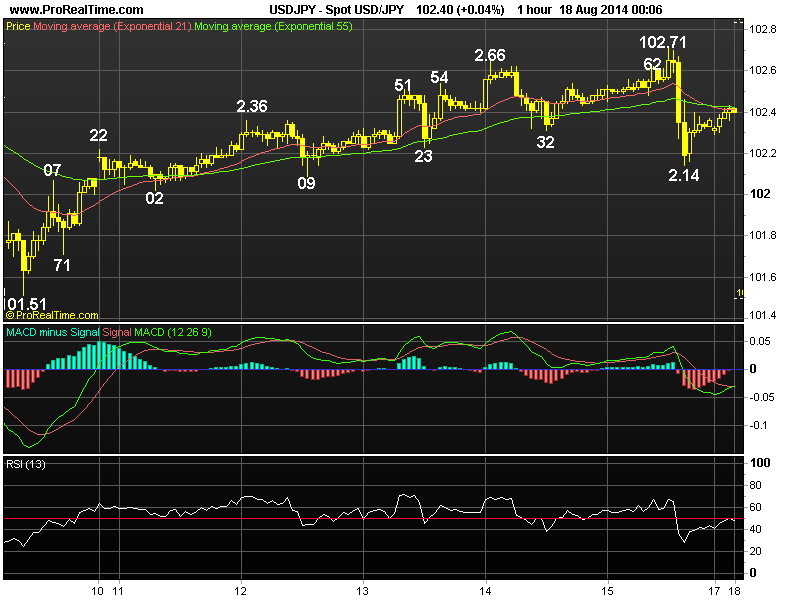

21 HR EMA

102.41

55 HR EMA

102.42

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

48

14 HR DMI

-ve

Daily Analysis

Choppy consolidation to continue

Resistance

103.15 - Jul 30 high

102.93 - Last Tue's high

102.72 - Last Fri's high

Support

102.14 - Last Fri's low

102.09 - Tue's low

101.78 - Aug 06 low

. USD/JPY - 102.40... Dlr continued its rise fm Aug's low at 101.51 at the start of last week n ratcheted higher for 5 consecutive days due to rally in the Nikkei, price climbed to 102.72 Fri b4 coming off pretty sharply to 102.14 in NY morning on risk-aversion buying of yen due to renewed tension in the Ukraine.

. Let's look at the bigger picture 1st, dlr's early erratic upmove fm 100.81 (May low) to 103.15 in Jul suggests price wud remain confined inside the MT well-trodden broad range of 105.45-100.76. Although the subsequent strg retreat to 101.51 suggests choppy sideways move is in store, last week aforesaid bounce to 102.72 Fri signals consolidation with upside bias remains n a daily close abv 102.71 wud encourage for re-test of 103.15, however, a break there is needed to extend further headway twd 104.13. In the event dlr penetrates 101.51 sup, then risk wud shift to the downside for weakness twd previous good sup area at 101.07/09 but 100.76/81 sup shud remain intact.

. Today, although Fri's retreat fm 102.72 suggests initial consolidation with downside bias wud be seen, reckon 101.95 ('dynamic' 61.8% r fm 101.51) wud contain weakness n bring rebound later today or tomorrow.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.