The UK: Minutes of the monetary-policy meeting more or less as expected

The distribution of votes was 9-0 in favour of an unchanged interest rate and purchase programme - as last time. If we take a closer look at the minutes, we sense a slight concern about the rapidly rising housing market (more or less solely related to London). In addition, it was slightly acknowledged that the job market may improve faster than expected when 'forward guidance' was announced in August. All in all, very neutral minutes - GBP weakened slightly. Investors may have expected slightly more.

Canada: Dovish Bank of Canada made CAD depreciate (1% against EUR and USD)

- BOC removed the sentence 'a normalisation (of the economy) should be expected to result in a normalisation of interest rates'.

- BOC is concerned about the downside of inflation

- BOC is concerned about the housing market and imbalances among households.

The new central-bank governor, Stephen Poloz, emphasised that the Bank of Canada's monetary policy will depend on incoming data and their effect on inflation.

Our assessment:

EURCAD is at the highest level since 2011. EURCAD at 144 is a very strong area of resistance. We believe that purchases of CAD against EUR and DKK at this level are attractive in the long term. A breach above 144 will, however, indicate further weakness. We recommend investors to sell EURCAD. See the chart overleaf.

Turkey: The central bank (CBRT) left interest rates unchanged - TRY depreciated As long as the CBRT is reluctant to raise interest rates, we expect TRY to underperform other EM currencies. TRY is currently one of the weakest links in the emerging market universe.

This is, among other things, due to the following:

- Wide current-account deficit

- Very few disposable FX reserves

- A very negative real interest rate

The latter results in portfolio inflows from other countries, which Turkey depends very much on, as point 1 and 2 may be much more uncertain and volatile.

China: HSBC's PMI for the industry rose more than consensus as we had expected

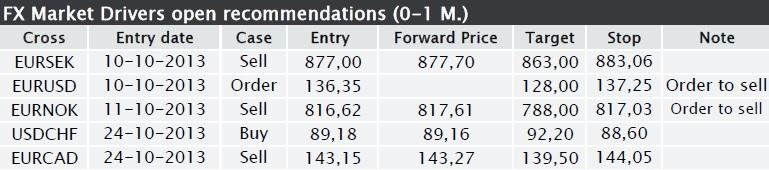

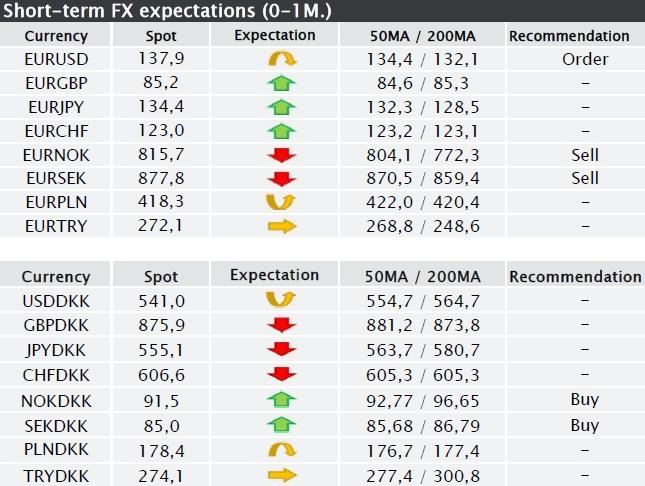

EURUSD (ORDER): We recommend a sell order at 136.35 with a close stop loss at 137.25.

There is a strong likelihood that the spot market will attempt to go for the stop loss levels that have been built up in the range of 138-138.50. The level at 140 offers strong resistance.

The current levels have previously marked the line in the sand for when European politicians and the ECB have focused on EUR. We expect that politicians will initially make comments about the currency as a problem for the budding European recovery (the French Minester of Industry made an announcement yesterday). Today's chart shows the trade-weighted EUR, which is at its highest level since 2011. Not exactly what Europe needs.

Support: 136.40, 134.50, 132.10 (200MA).

Resistance: 138 and 140.

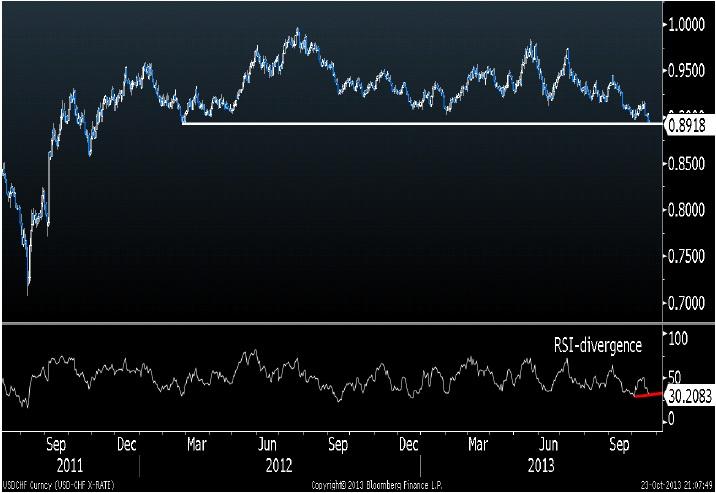

USDCHF (NEUTRAL to BUY): We recommend BUY and to take profit at 92.20. Stop-loss at 88.60.

Based on a technical analysis, USDCHF is attractive - we are close to a critical level of support. The illustrated RSI divergence supports that the movement is oversold and that a correction is imminent. The question is of course whether we will see a downward breach with a significant movement beforehand (remember stop/loss). We do not believe so. On the other hand, one should not be too greedy - we aim for a correction.

USDCHF

EURNOK (SELL): We recommend investors to sell EURNOK. We have adjusted stop/loss to 817.03.

Today's interest-rate meeting is expected to be a non-event. It is most likely that Norges Bank will indicate a lowering of the interest rate path, but since we will only see a brief press release nothing tangible will be announced. The most important event from now and until the interest-rate meeting in December is the inflation data on 11 November.

We maintain our recommended sell for the short term (0-1M) as well as for the long term (1-6M).

EURSEK (SELL): We recommend that investors sell EURSEK with take-profit at 863.00. S/L at 883.06.

Riksbanken's interest-rate meeting is, if possible, even to a higher degree expected to be a non-event than the interest-rate meeting at Norges Bank. The two doves at the interest rate committee are very much isolated, and the two 'swingers' (Jansson and Skingsley) have recently expressed great satisfaction with the current monetary policy.

It is worth noting that the Shadow committee, which is made by the newspaper Dagens Industri and consists of a number of senior economists from the financial sector and universities, estimates that interest rates should be lowered. Two out of six members believe that interest rates should be reduced by 50 bp. This indicates that the Swedish economy is still fragile and that Riksbanken very much rely on that Riksbanken is responsible for financial stability and the housing market.

Support: 859-860 (200 MA)

Resistance: 883 and 890

Today’s events:

09.30 SEK: Interest-rate announcement from Riksbanken (we expect interest rates to be left unchanged)

09.58 EUR: PMIs (we expect 51.4 for the industry and 53.7 for the service sector)

10.00 NOK: Interest-rate announcement from Norges Bank (we expect interest rates to be left unchanged)

14.58 USD: PMI for the industry (estimate: 52.5)

Chart of the day: Trade weighted EUR on highest level since 2011

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.