Key Highlights

-

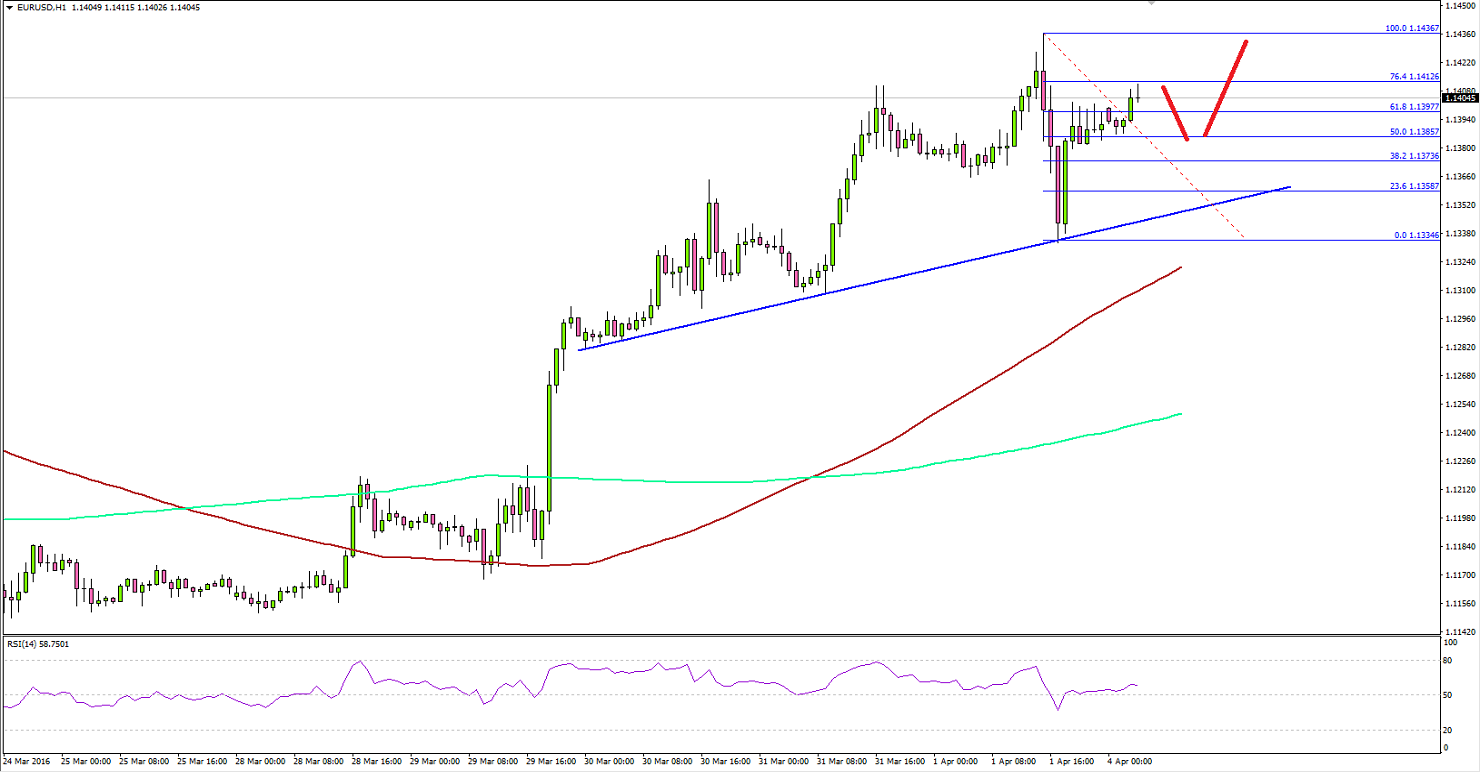

Euro gained traction recently against the US Dollar, and currently trading with a bullish bias.

-

There is a bullish trend line formed on the hourly chart of the EURUSD pair, which may act as a support if the pair moves down.

-

Today, the Euro Area Producer Price Index (PPI) will be released by the Eurostat, which is forecasted to decrease by 0.6% in Feb 2016, compared with the previous month.

-

Earlier during the Asian session, the Australian TD Securities Inflation released by The University of Melbourne - Faculty of Economics and Commerce posted 0% in March 2016.

EURUSD Technical Analysis

The Euro traded above 1.1400 resistance area against the US Dollar recently, and it looks like poised for more gains in the short term. There is a bullish trend line formed on the hourly chart of the EURUSD pair, which may act as a support for the pair if it moves down or corrects lower from the current levels.

On the upside, the 1.1420-30 area can be seen as a resistance, which must be breached by the bulls if they have to take the pair higher.

On the downside, a short-term support can be at 1.1380.

Euro Area PPI

Today, the Euro Area Producer Price Index (PPI), which is an index that measures the change in prices received by domestic producers of commodities will be released by the Eurostat. The forecast is slated to decrease by 0.6% in Feb 2016, compared with the previous month. In terms of the yearly change, the Euro Area PPI is expected to decrease by 4%.

Moreover, the Euro area unemployment rate will also be released, which may impact the Euro in the short term.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.