Key Highlights

Euro enjoyed decent gains against the US Dollar recently until it found sellers around 1.1110.

Euro Area Manufacturing Purchasing Managers Index (PMI) will be released by the Markit Economics, which is expected to come in around 52.0 for July 2015.

Chinese official non-manufacturing PMI, released by China Federation of Logistics and Purchasing (CFLP) came in at 53.9, up from the last reading of 53.8.

Australian AIG performance of the Mfg Index released by the Australian Industry Group posted a nasty increase from 44.2 to 50.4.

EURUSD Technical Analysis

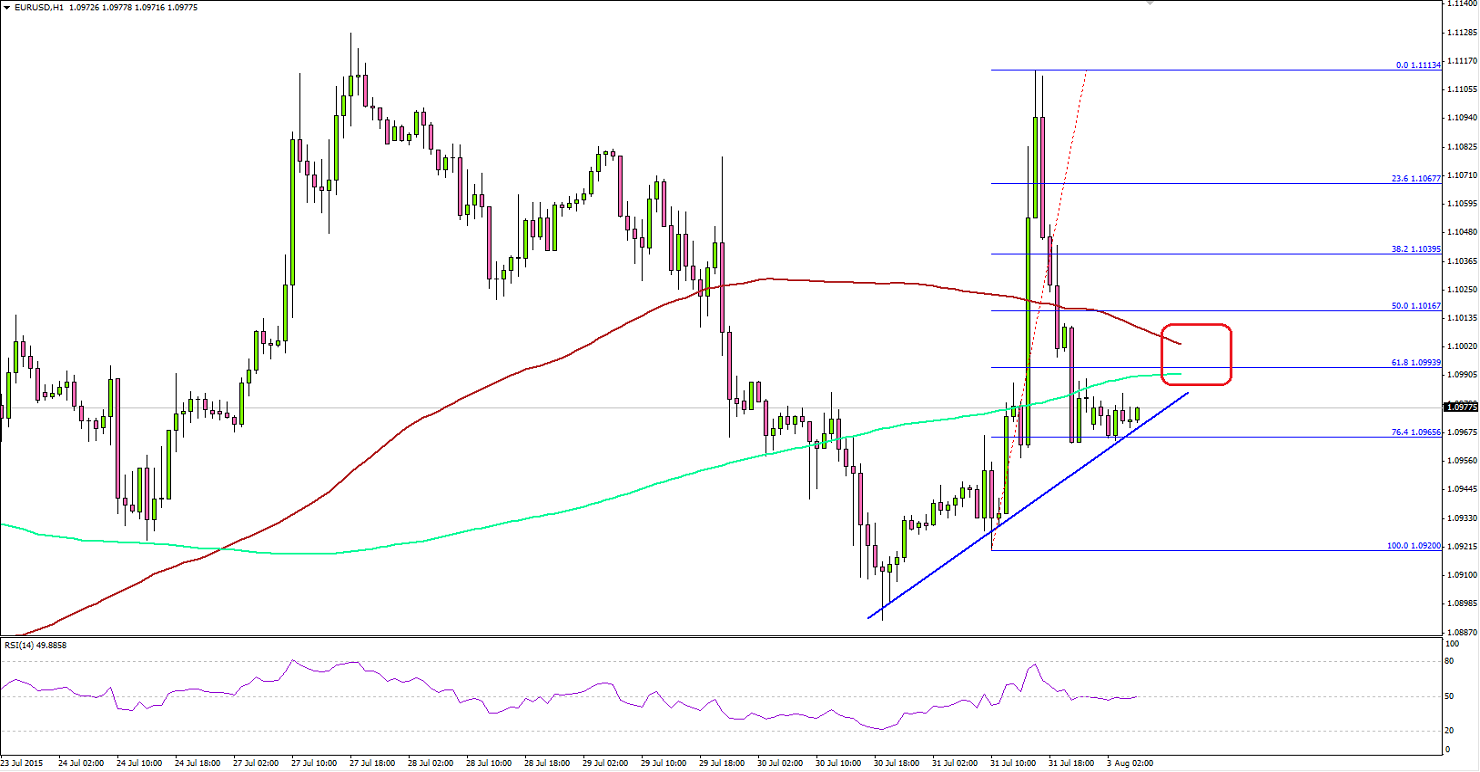

The EURUSD pair recently spiked higher to trade near 1.1110 resistance zone where it found sellers, which ignited a downside reaction. The selling interest was very strong, as sellers managed to clear the 100 and 200 hourly simple moving average. However, there was a support formed around the 76.4% Fib retracement level of the last leg from the 1.0920 low to 1.1113 high.

Moreover, there is also a bullish trend line on the hourly chart, which is acting as a hurdle for sellers but we cannot discard the fact that there is a lot of bearish pressure on the pair. So, if the pair stays below the 100 hourly SMA more losses are likely. A break below the highlighted trend line could take the pair towards the last swing low of 1.0920.

On the upside, if the pair moves above both the key SMA’s, then it might call for a chance of trend. A major barrier is around the 1.1060-80 resistance area, followed by the last swing high of 1.1110.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.