Analysis for July 11th, 2014

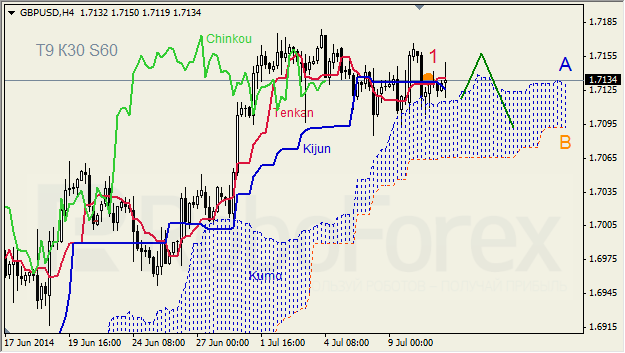

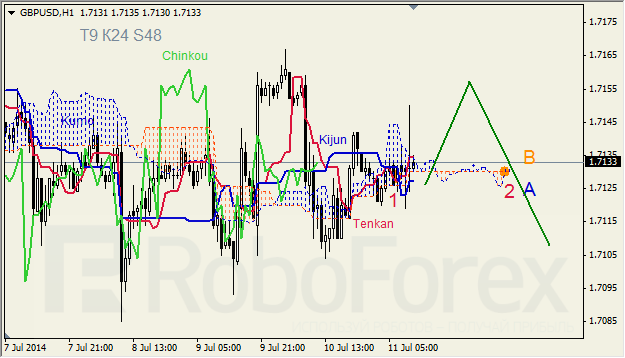

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Golden Cross” above Kumo (1). Ichimoku Cloud is going up (2), Chinkou Lagging Span is close to the chart, and the price is inside Tenkan-Sen – Kijun-Sen channel. Short‑term forecast: we can expect support from Senkou Span A, and attempts of the price to stay inside Kumo.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1). Ichimoku Cloud is closed (2), Chinkou Lagging Span is above the chart, and the price is inside Kumo. Short‑term forecast: we can expect support Kijun-Sen, and growth of the price.

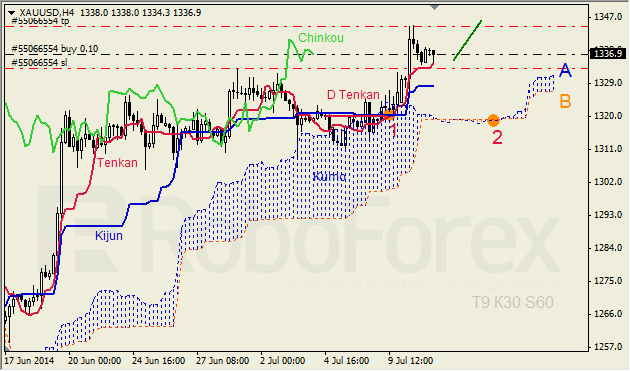

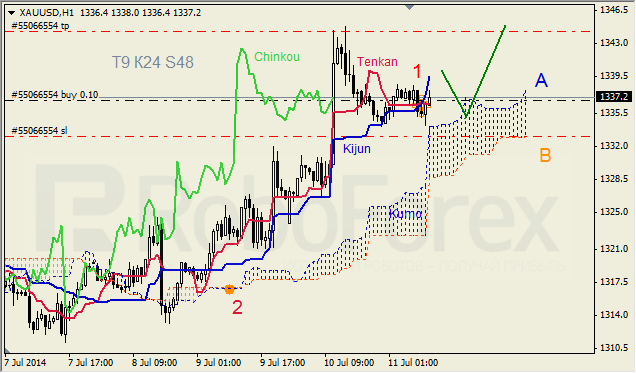

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); Tenkan-Sen and Senkou Span A are directed upwards. Ichimoku Cloud is going up (2), and Chinkou Lagging Span is above the chart. Short-term forecast: we can expect support from Tenkan-Sen, and growth of the price.

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1); Kijun-Sen and Senkou Span A are directed upwards. Ichimoku Cloud is going up (2), and Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect support from Senkou Span A.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.