Analysis for August 04th, 2014

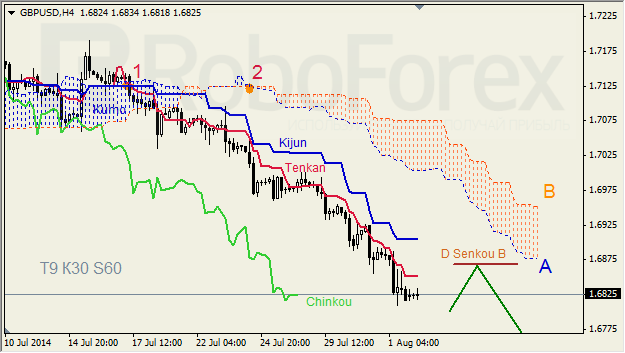

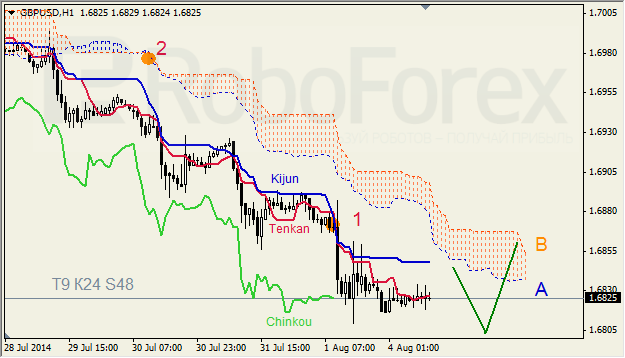

GBP USD, “Great Britain Pound vs US Dollar”

On H4 chart Tenkan and Kijun are influenced by the «Dead Cross» (1), price had accepted area below daily Kumo, Ichimoku Cloud is going down (2), lagging line of Chinkou indicator is located below the chart. We can expect that price will get back to Kumo after breakout on a daily chart and go down after that.

At H1 chart, Tenkan and Kijun have moved apart below Kumo via «Dead cross» (1), Chinkou gets closer to the chart, Ichimoko cloud is going down (2). In a short-term perspective we can expect resistance from Kijun – Senkou A and attempt to hold within a cloud.

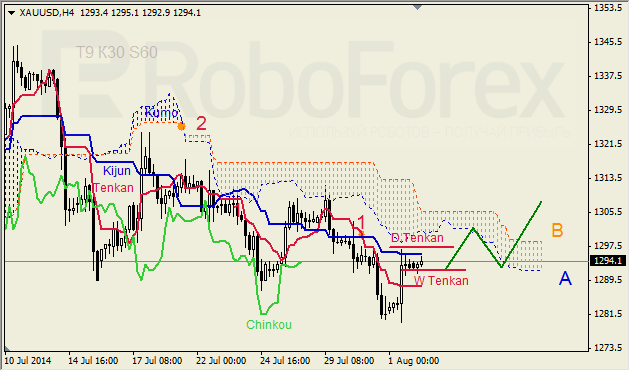

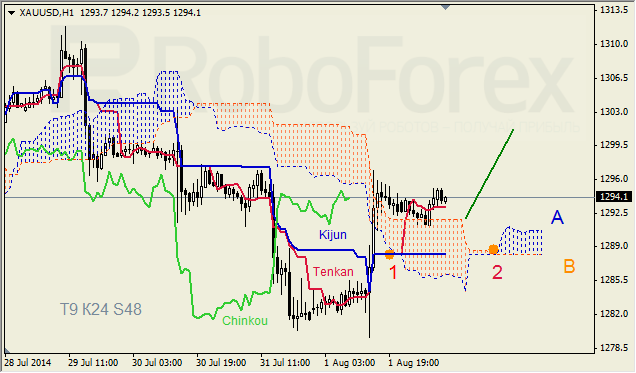

XAU USD, “Gold vs US Dollar”

Tenkan and Kijun have moved apart below Kumo via “Dead сross” (1). Ichimoku cloud is going down (2). Chinkou is located below the chart. In short-term perspective, we can expect support from W Tenkan, resistance from Senkou A and attempt of price to hold above Kumo.

Tenkan and Kijun have crossed each other via «Golden cross» below Kumo (1), Ichimoku cloud is going up (2), Chinkou is above the chart. In short-term perspective we may expect support from Tenkan-Senkou B and further growth of the price.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.