Analysis for July 18th, 2014

GBP USD, “Great Britain Pound vs US Dollar”

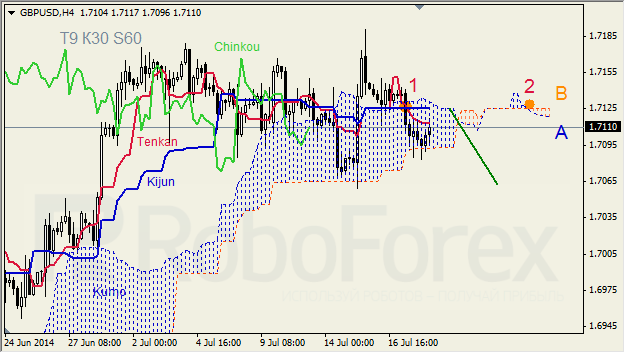

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Dead Cross” (1) inside Kumo. Ichimoku Cloud is gong down (2), Chinkou Lagging Span is below the chart, and the price is inside Kumo. Short‑term forecast: we can expect another attempt of the price to stay below Kumo.

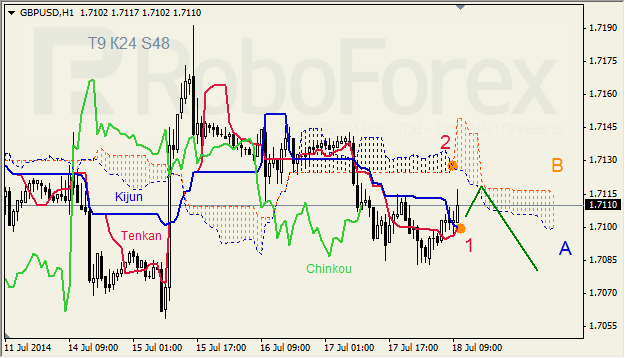

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are close to each other below Kumo (1). Ichimoku Cloud is going down (2), and Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect resistance from Senkou Span A, and decline of the price.

XAU USD, “Gold vs US Dollar”

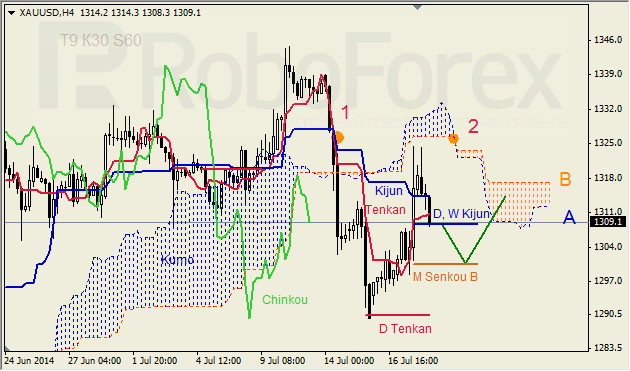

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1). Ichimoku Cloud is going down (2), and Chinkou Lagging Span is below the chart. Short-term forecast: we can expect support from M Senkou Span B.

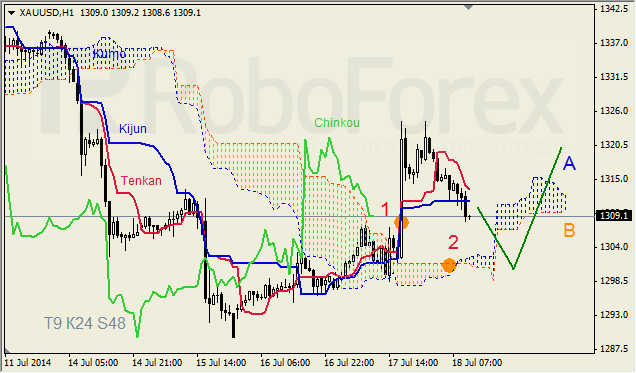

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); right now they’re getting closer to each other above Kumo. Ichimoku Cloud is going up (2), and Chinkou Lagging Span is above the chart. Short‑term forecast: we can expect decline of the price and support from Senkou Span B.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.