Analysis for March 5th, 2014

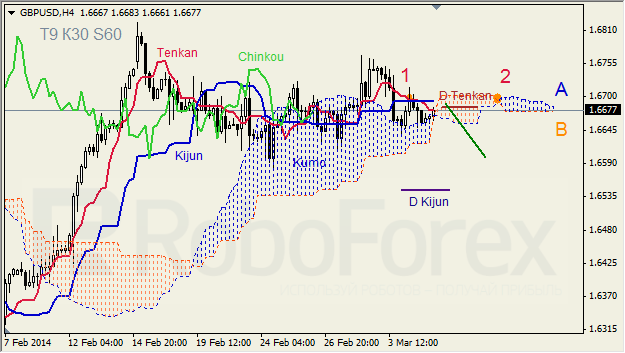

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1). Ichimoku Cloud is going up (2) and almost closed, and Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect resistance from D Tenkan-Sen – Tenkan-Sen – Kijun-Sen – Senkou Span B, and decline of the price.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1); Tenkan-Sen is directed upwards, Kijun-Sen is moving downwards. Ichimoku Cloud is going down (2), and Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect resistance from Senkou Span A, and decline of the price.

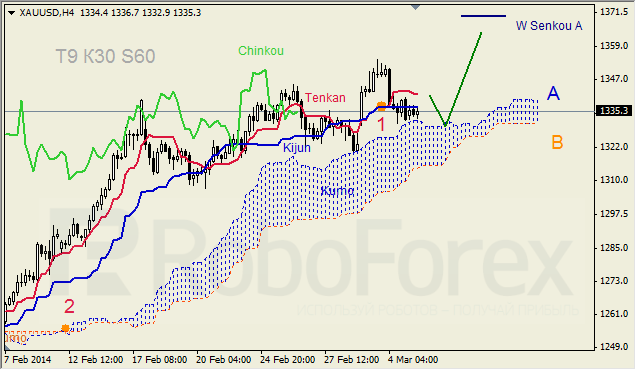

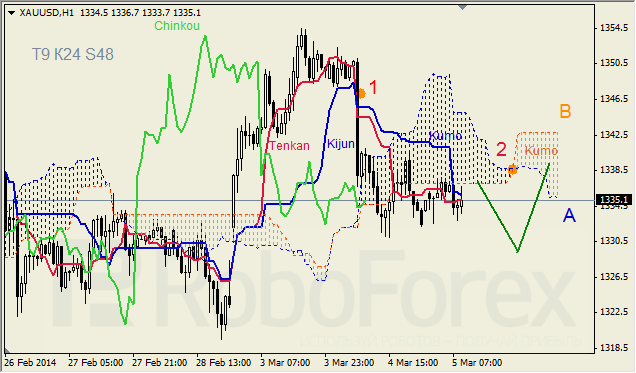

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Golden Cross” (1) above Kumo Cloud. Ichimoku Cloud is going up (2), and Chinkou Lagging Span is very close to the chart. Short-term forecast: we can expect support from Senkou Span A, and growth of the price.

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1) below Kumo; the lines are close to each other. Ichimoku Cloud is going down (2), and Chinkou Lagging Span is below the chart. Short‑term forecast: we can expect resistance from Senkou Span B, and attempts of the price to stay inside Kumo.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.