If the Ms. Yellen and her fellow policy makers do happen to pull the rate trigger later this afternoon (2pm EST), it will be the first U.S rate hike in just under a decade. It’s not what the Fed does; a hike of 25bps or less, but what they say that investors should focus on. Capital markets need to be reassured that future rate increases will “only be very gradual” in nature, in fact baby steps back towards rate normalization. The call is so close with various surveys seeing a near-even split among economists, while fixed-income dealers are pricing in roughly a +23% chance of a rate liftoff.

The “yes” hike camp have pointed to a U.S economy with near full employment (+5.1%), and if you included the recent growth in the money supply argument, coupled with domestic economic growth signs across the board, certainly justifies a domestic rate hike call.

Despite U.S headline inflation remaining relatively subdued, it continues to give investors a misleading impression. The global low price syndrome is an energy and commodity based issue – energy prices declined -2% last month stateside. Yesterday, the U.S CPI headline for August turned negative (-0.1% m/m) for the first time in nine-months, while the core-CPI (+1.8% y/y) exhibited tepid growth. As CPI is not the Fed’s preferred measure of inflation, the decline in the core headline could figure into today’s meeting as just another sign that U.S policy makers are some ways away from meeting its price goals. Therefore a token hike is unlikely to do much harm to the U.S economy. If there is one, it should be accompanied with a “dovish” statement.

The Fed needs to keep its credibility intact, especially with Ms. Yellen being so vocal on a hike in 2015. If U.S policy makers leave it too late, there is a danger of having to play catch up, and this could only cause more problems, especially to consumer spending and business confidence at a later date.

Nevertheless, the Fed is in a tough spot, they have their domestic reasons to hike, but being “the” global leader; it’s not just the impact on their own economy that they have to worry about. With the dollar’s dominant reserve currency status, today’s decision will have a massive impact for the global economy as a whole, and Ms. Yellen and company cannot ignore that. So, either way, what they communicate is of the utmost importance.

In the “no” camp there are a plethora of reasons not to hike today. Aside from the subdued inflation argument (highlighted above), the mighty dollar remains underpinned by elevated yields. In time, a stronger dollar will have a negative impact on the U.S economy. A couple of Fed speakers (Dudley and Williams) have stated that the U.S economy is showing an “amber light, not green.” Despite backing herself into a corner on a hike for this year, there still is time in October and December for the Fed to carry out Yellen’s wishes. Now that global economies haven taken on so much U.S debt, especially emerging markets (EM), any Fed tightening will cause further financial disruption to these weaker economies. Does the Fed really want to insight further financial instability at this point?

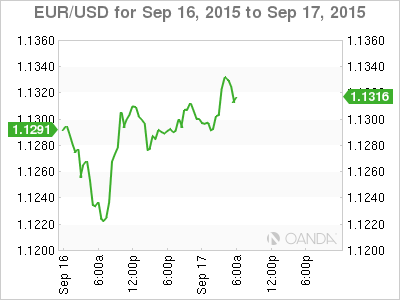

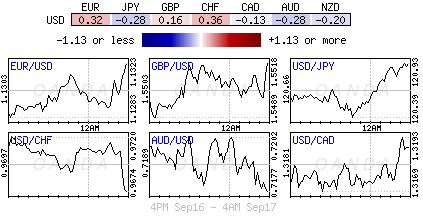

**No matter what transpires later this afternoon, price movements across the various asset classes are expected to be extremely volatile, especially as more dealers return back to the market after having pared their exposure pre-Fed announcement.**

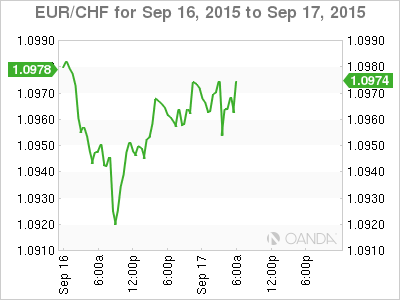

The Swiss National Bank (SNB) did what was expected of them earlier this morning. They left their deposit rates unchanged at -0.75% while keeping its targeted three-month Libor band intact (-1.25% to -0.25%). Despite fundamentals, it would have been difficult for any central bank to preempt the Fed. Not much of a surprise, the SNB noted that the CHF remains over valued and poses a “challenging situation for many companies.” The SNB again went out of their way to stress that they will remain “active” in the forex markets.

Overnight, the Bank of Japan (BoJ) Governor Kuroda said he is ready to act, but he did not provide a clue about whether they will ease monetary policy further in the near term. Earlier this week the BoJ kept monetary policy unchanged, but toned down there assessment of the domestic economy as slowing emerging economies are undermining their efforts. Most economists do not see the BoJ being able to achieve its +2% inflation target by the intended timeframe of H1 of 2016, and are certainly more vocal over the waning effect of Abenomics. Do not be surprised to see PM Abe and the BoJ step up stimulus efforts next month.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.