Greece situation sets off highest market volatility since 2008

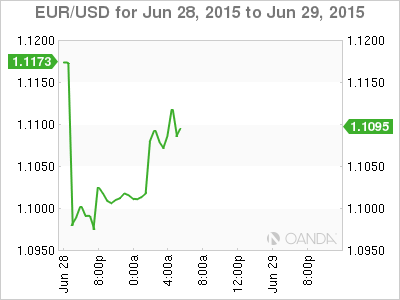

EUR filling in that plummeting gap

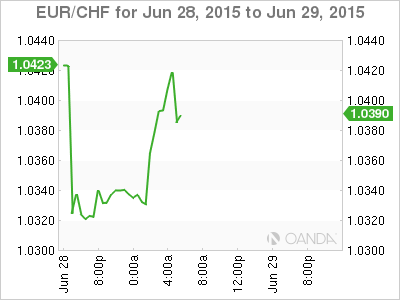

SNB vocal about today’s intervention

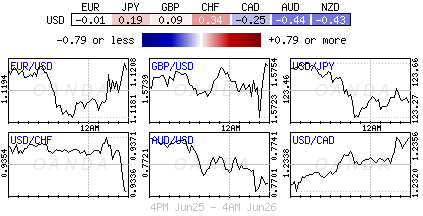

Market looking to Yen for help

Finding temporary safety to alleviate some of the Grexit pressure that is currently being imposed on capital markets is not that easy. Even the traditional safer option, like owning CHF, is becoming a bit of a problem. The weekends moves by the Greek government to call for a referendum on July 5 ensue there is no quick fix for their situation.

A referendum in favor of PM Tsipras position virtually guarantees Grexit, while support for Greece’s creditors offer should automatically force new federal elections and lead to further months of delays. At this point it would be difficult to get the Eurozone back to the negotiation table, they have lost their patience with Greece. Only a significant and sustainable market selloff will be able to pressure the eurozone to want to talk.

However, the probability that the Greek populace would vote to stay within the EU confines could provide the basis for more talks and negotiations. Nonetheless, until then, Greek capital controls will probably remain in place, while tomorrow Greece is now expected to default on its IMF loans.

Safe Haven Picks Difficult

There are no sure safe haven bets. In times of flight, investors historically gravitate towards the reliable – gold, CHF, JPY, USD, bonds – but that too is currently sending some mixed signals.

The EUR naturally took a beating on the Asian open, plummeting a big figure and change from Friday’s close to €1.0966, and has since managed to fill in the free fall gap mostly on eurozone rhetoric. Nevertheless, with the eurozone’s current predicament, the EUR bear will continue to feel confident that they have the upper hand.

It’s natural to see hedge funds wanting to lighten up on their Euro periphery bond exposure, especially when they had been expecting an eleventh hour deal. However, despite the heavy selloff in eurozone bonds this morning, current yields would suggest that the market remains somewhat content that Greece is not entirely on the verge of leaving the eurozone. Hotspot countries like Spain Italy and Portugal yield spreads to the German Bund have only managed to widen out to levels printed a week ago. Thus far, all the market seems to have done is price out some of last week’s initial optimism that a deal would be done. Periphery bond prices remain some ways off from pricing in a Grexit knock-on effect just yet.

Even U.S treasury yields are not portraying that sinking feeling. Yes, bonds have rallied along with other core eurozone bonds, but they are well off their intraday low yield print during the Asian session. U.S 10-years trade at +2.35%, falling from Friday’s close of +2.40% and rising from the overnight low of +2.30%. U.S yields have fair bit of domestic data to chew through before shutting down for the holiday-shortened week. Obviously Thursday’s non-farm payroll (NFP) report will be of particular interest to both money market and fixed income traders. They have yet to convincingly price in a September rate lift off, it’s still 50-50.

Swiss National Bank (SNB): The Outlier

The SNB’s underhanded policy moves it pulled last January (scrapping the €1.20 currency cap) certainly left a bad taste in investors’ mouths. Nevertheless, their currency is historically always in demand during “fight or flight” situations. However, it has been a prudent move to listen to SNB Jordan for directional clues, especially when the Swiss franc remains in such demand mostly from a safe-haven perspective.

The SNB has been intervening in the forex market since they abandoned the EUR/CHF peg five-months ago, but they would not confirm such intervention. Last week the SNB again reiterated that it could still intervene in the forex market, and/or apply more negative interest rates to release some of the external pressures on their currency. Verbal intervention seems to be the first tool of choice to weaken a currency. Still, today the SNB took an unusual step and said that they have intervened in the market.

Being proactive and vocal would suggest that Swiss policy makers want to discourage speculative “long” CHF positions to accumulate. The SNB acknowledges the “extreme uncertainty” that policy makers have to currently digest, but also admits that the SNB is not unprepared for a Greek default – they will be active. The SNB has already set a precedent of not sticking to the script. Therefor, owning CHF is not as easy or safe as it once was. Perhaps the SNB is required to go more negative on rates.

Because of the SNB actions, investors seem to be gravitating more towards JPY for primary surety reasons. Market consensus believes that the Bank of Japan (BoJ) is likely to be happy to see JPY (¥122.87) pullback from its recent lows. Politicians have been trying to talk yen back up for awhile and this move has been rather orderly.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.