Investors keeping tabs on intraday price moves

EUR emerges again as a funding currency

Euro leaders want a Greek conclusion by tonight

Germany losing economic momentum

If nothing else, investors would be hard pressed not to find the current trading environment a challenge. Only weeks ago central banks forewarned investors about heightened market volatility. So far, they have been true to their word. Market ranges may be contained, but the intraday price movements among the various asset classes -commodities, equities, fixed income and currencies- have either been very profitable or costly to many.

Central Banks have been calming investors for the past seven-years with low interest rates, bond buying and other interventions aimed at shoring up weak economies. Going forward, monetary policy makers are slowly beginning to step out of markets in a variety of ways. This mix of overt and subtle withdrawal of market support is a key macro driver of recent increased volatility. To date, the markets have been at risk of becoming distorted and overly reliant on policy makers for direction, hence participants need weaning off. Central Bankers are herding the investor back to basics and data dependency.

EUR to reemerge as a funding currency

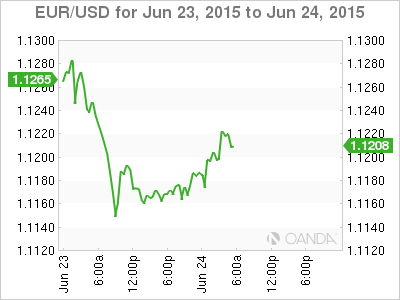

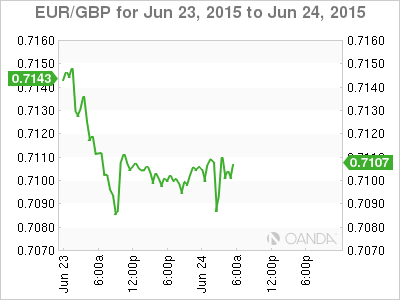

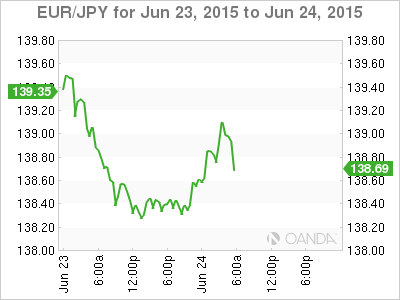

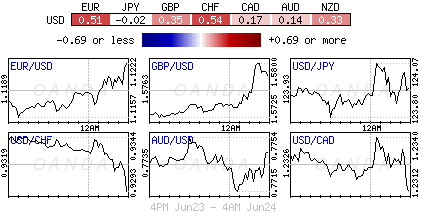

Despite the Grexit event risk on display, U.S markets have begun this week largely looking past Greece and refocusing on U.S data and rate expectations. Already the USD has rebounded as interest rates back up. For many, the single units move lower (€1.1200) over the past 24-hours has been more puzzling than anything. The market had expected that a reduction in Greek risk would be a positive for the common currency. However, the EUR’s intraday moves, although not oblivious, have so far this week seemed indifferent to the Greek talks.

It appears that the easing of tension between Greece and Euro creditors is giving speculators the confidence to take on more risk, pushing the USD to build upon recent gains against the majors and commodity-related pairs. The optimism on Greece seems to be bringing the focus back on the Federal Reserve and its first potential rate hike. Once Grexit finally gets pushed off the table, investors should be expecting the EUR”s role as a funding currency again take flight with investors turning back to U.S economic fundamentals for directional guidance.

That being said, the current Greek saga needs to come to a conclusion. European leaders want today’s negotiations between Greece and its creditors to conclude at today’s Eurogroup meeting. They do not expect to spill over into tomorrow’s leaders summit. This would suggest that capital markets may not get a clear picture on how things are progressing for sometime, as negotiations could go on all night. If this is the case, it could make for a long day for many traders.

PM Tsipras has a domestic tough sell

Assuming that everything goes well at today’s Eurogroup meeting and tomorrow’s Summit in Brussels, then everything is handed over to the Greek and German parliaments for approval. For Greece, voting could occur over the weekend and once completed, then the German parliament will be presented with an extension of the Greek bailout program. The Germans could vote next Monday June 29.

However, even if Greek Prime Minister Tsipras come to an agreement with his international creditors, his problems are only beginning as its Greece’s domestic politics may prove to be the bigger stumbling block. The PM has always been under pressure to come to a deal close to his agenda, but due to the urgency of the situation he has had to conform, and this has never stood well with the more radical element of the governing coalition. If Tsipras thought it was a tough sell in Europe, it’s perhaps an even tougher sell domestically.

There are many moving parts to this ongoing saga and assuming that things do progress, and we make it to the Greek ratification stage at the weekend, the markets should be expecting heightened volatility as we also complete quarter and half-year end in capital markets.

German business confidence disappoints

At this very moment the Euro markets are finding it difficult to buy into fundamental data points as they are fixated and focused on Greece. The EUR made a weak attempt to trade ahead of this morning’s German Ifo business climate numbers. Pre-release trading pushed the unit to its intraday high (€1.1227), but the headline release did not live up to expectations and has since been weighing on the single currency. German business confidence fell sharply last month, and by more than expected (107.4 vs. 108.5). It’s the lowest headline print in four-months.

The headline print would suggest that the outlook for the German economy is “muted.” Year to date, the index has been pointing to solid economic growth for the country, today’s number indicates that it may be losing some of that momentum. Other German data has been producing mixed signals and backing up the losing “momentum” theory (Germany’s ZEW’s economic expectations slumped to a seven-month and yesterday’s German PMI was an upbeat surprise).

Nonetheless, German data adds to the notion that the ECB’s QE is expected to be maintained at the current pace and run at least until September 2016. This will provide fodder for the EUR bear, especially on any single currency rallies.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.