An eleventh hour break through by Greece

Greek capital controls remain a reality

ECB offers daily lifeline through its ELA program

Yen losing its safe haven mojo

It’s normal and certainly more prudent to find most investors prefer dealing with the facts, while speculators on the other hand, do just that, and speculate. Yesterday’s supposed breakthrough in Greek/European talks are either beautifully timed at the eleventh hour by the inexperienced Greek PM, or “forced” lucked by a bunch of frustrated European officials.

Fact, there has been a calculated breakthrough in Greece’s talks with its creditors. Fact, both sides are short on details, but over the next two day’s a lot of work is required to be done, so the market has been told. Nevertheless, it seems that both Euro officials and Greece’s Syriza party are confident that the ‘process’ could be finalized this week, thus avoiding potential Greek capital controls, a debt default and Grexit. For most investors, they prefer to see it in black and white, while the speculator is making most of the market noise and adding risk again to their portfolios.

Greek Capital Controls Not Gone Away

In reality, the threat of capital controls remains ever present for Greece. Currently, the ECB continues to offer a daily lifeline to Greek financial institutions through their Emergency Liquidity Assistance (ELA) program. Earlier today, it was again necessary for the European Central Bank (ECB) to provide extra cash for the fourth time in seven day’s after another +€1.6b left the Greek banking system yesterday. On the flip side and when necessary, the Greek government should find it a tad easier to sell its proposals to their own government citing the constant threat of capital controls and flight of capital as a leverage.

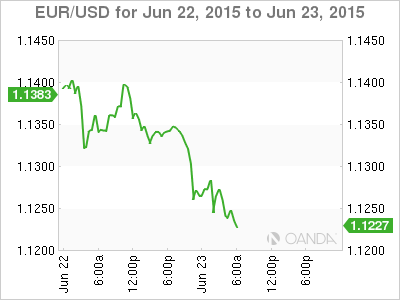

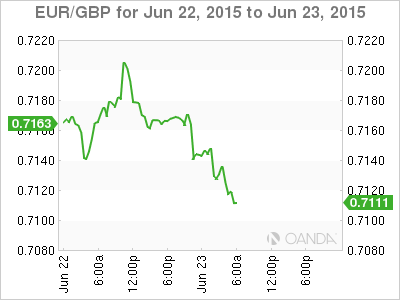

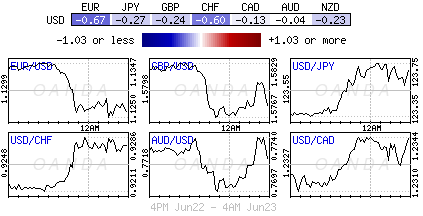

So far this week, the speculator has been pricing in a lot of market optimism ahead of tomorrows Eurogroup meeting, pushing both equity prices and Euro sovereign yields higher. For the investor, the EUR’s move lower over the past 24-hours has perhaps been a tad more puzzling than anything. Many had been expecting that with a reduction in Greek risk would be a positive for the common currency. However, the single unit so far this week seems indifferent to the Greek talks.

For the speculator, the easing of tension between interested parties has allowed the taking on of more risk, pushing the USD to build upon recent gains against the majors and commodity-related pairs. The optimism on Greece is perhaps bringing the focus back on the Fed and their first potential rate hike. With rate divergence back on the table is allowing many to reconsider re-entering one of the most popular traders of this year – short EUR/USD.

Single unit unable to benefit from stronger data

The EUR outright is trading at a one week low (€1.1235) and is unable to benefit from better data in the euro session ahead of the U.S open. Despite the eurozone economy appearing to rediscover its drive in June, the single unit seems content in cracking the psychological €1.1200 handle sooner rather than later.

Earlier this morning, Euro PMI’s surveys pointed to acceleration in the growth of the business activity. The composite PMI (measure of services and manufacturing activity) rose to 54.1 from 53.6 in May. The highest monthly level printed in over two-years. The details revealed that both the services and manufacturing sectors both picked up, although the “new order” component slowed for a third consecutive month. This may suggest, until Greece’s issues are resolved it’s not going to get any better. Despite the rosier picture, an ongoing concern for the ECB will be the fact that businesses continue to cut their prices.

Asian PMI’s provide mixed feelings

Thankfully Europe has not cornered market volatility entirely. In China, the Shanghai composite trading resumed where it left off last week, with another selloff in spite of equity strength being recorded nearly everywhere else. Not helping were the mixed results from China’s June flash manufacturing PMI data. Despite the headline print remaining in contraction for a fourth consecutive month (49.6), the print was above consensus (49.4). Nevertheless, the devil can always be found in the details. The output component rose to 50.0. Both new orders and backlog components were also notably stronger, but perhaps most important, the employment conditions print deteriorated further.

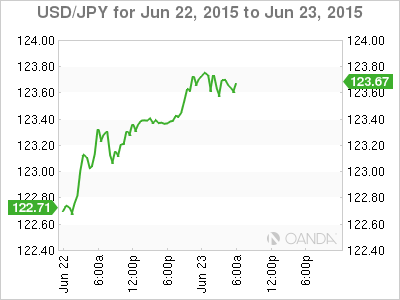

Not wanting to go it alone, Japan’s preliminary manufacturing PMI slid back into marginal contraction (49.9), as production growth slowed and new order demand contract for the third-time this year. Similar to China, Japan PMI employment component was also soft, even though Japan’s more favorable exchange rate (¥123.66) translated into an upbeat exports view.

The USD remains well supported against the yen at the moment for a number of reasons. The Bank of Japan (BoJ) monetary policies are still divergent, even if the Fed’s first rate-hike timing remains vague. Currently, rising Japanese energy import costs are bearish for JPY as export volumes struggle. Finally, CHF and GBP has been sapping the yen of some traditional safe haven Greek flows and is allowing the recent surge in speculative yen shorts to support USD/JPY on pullbacks at the moment.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.